Welcome to the post to acquire the best possible info about your card! From login, application, payment of bills, customer care, troubleshooting steps, FAQs, and a lot more; we have got it all covered just for you! So, stay tuned till the end if you do not wish to miss out on any important detail about your card. Yard Card Application fees and yearly costs are free for its customers.

It’s a credit line that is open and you can use it for future transactions, services, and purchases. Promotional loan deals and affordable interest rates, you have access to all of them! You get the flexibility and the extra convenience of paying overtime. With Yard card, a special credit line to assist with the daily use of cash and bank cards. Customers who use the Yard Card login service can manage their accounts online and track purchases, make payments, and more. There’s no need for a personal guarantor (applies to business accounts that meet specific criteria.)

One of the top ten banks in North America is TD Bank, America’s Most Convenient Bank®. Delivering exceptional customer experiences that are one-of-a-kind, practical, and hassle-free is the foundation of their business. Let us now begin our post to explore important steps and information!

Table of Contents

With effective finance offerings, you may give your clients the purchasing power they require to get what they desire.

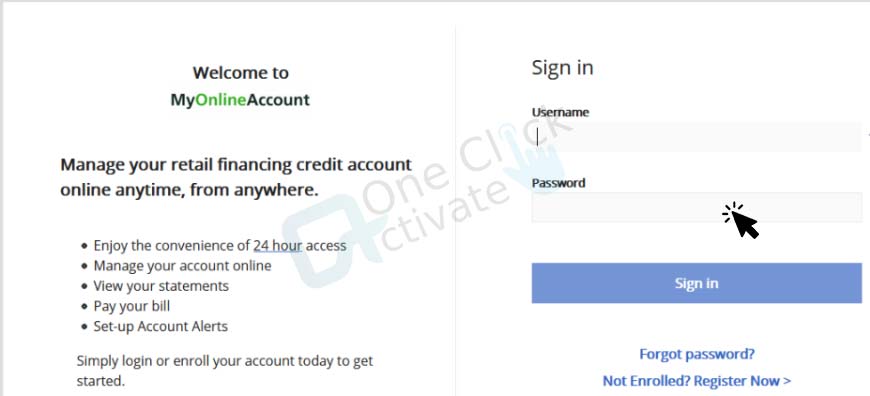

Online access is available 24/7/365 for managing your retail financing credit account-

Benefits for businesses:

Benefit from the conveniences and security as well!

Pay bills automatically:

To keep on top of your payments, set up pre-authorized payment on your TD Credit Card.

Security and Protection:

Using your TD Credit Card to pay your payments lowers your risk of identity theft and check loss or theft in the mail.

Rewards:

Pre-Authorized Payments for recurring bills on your TD Credit Card Account will help you attain your reward goals more quickly.

With a tailored retail sales private label financing program created for your company, TD Retail Sales Services can increase sales and foster customer loyalty. It offers partnership programs for companies of different sizes in practically every industry, so you can find the one that’s best for you.

Coming to financial capability, one of the most powerful financial institutions in the world is TD.

Also Read: Activate PayPal Prepaid Card

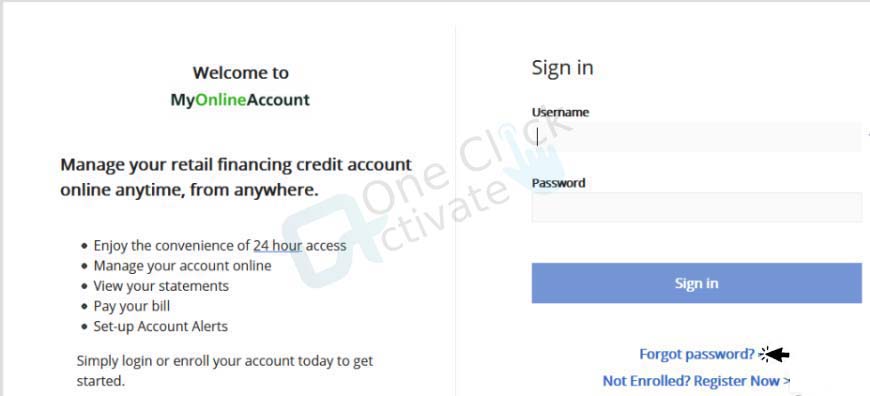

You can manage your credit card by logging into your account if you have a Yard Credit Card.

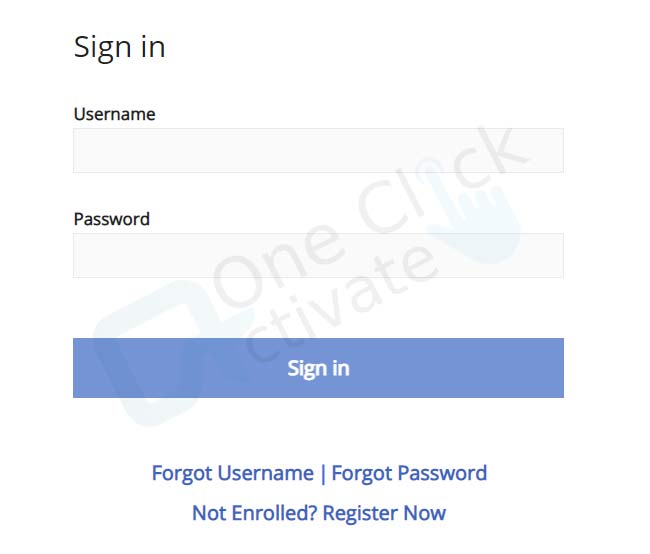

The following are the steps for the Yard Card Login:

You can complete the process by following the below instructions on the Yard Card login website.

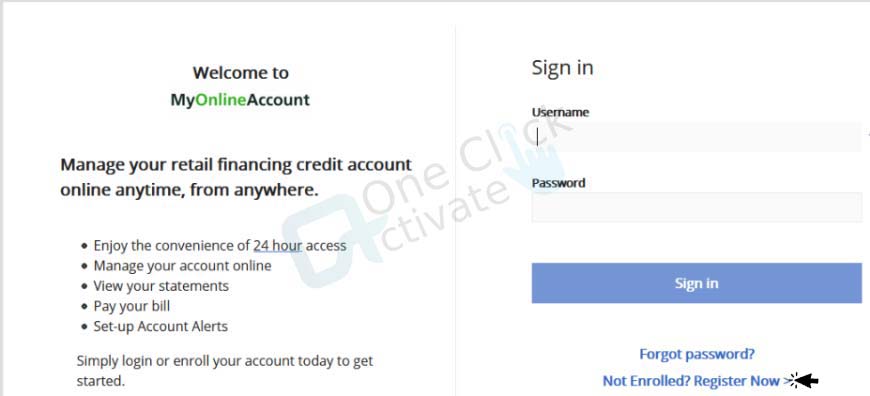

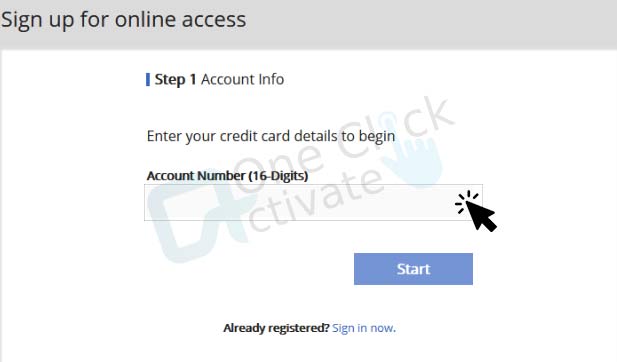

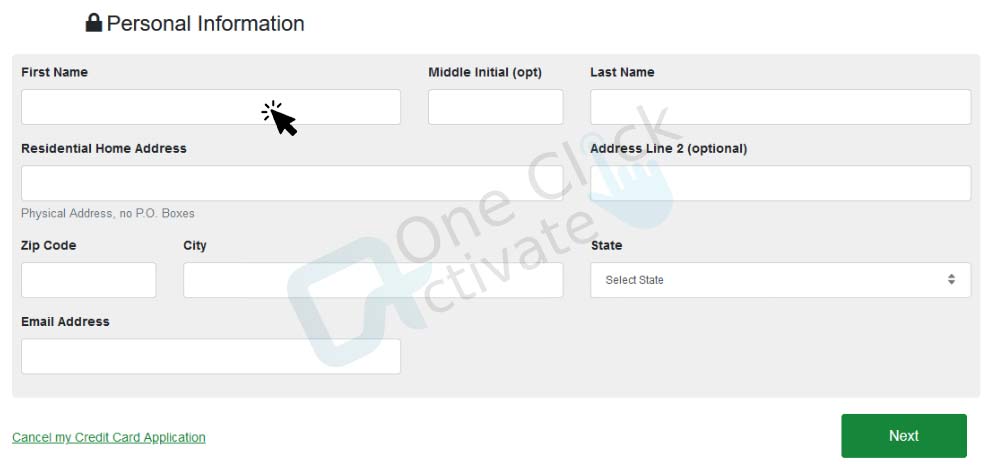

The following are the steps for applying for a Yard credit card:

Create your username and password by following the instructions on the Yard credit card website.

Do you want to boost sales? Offer your clients Yard Card Financing. It is a market-leading Lawn & Garden financing service that enables your clients to purchase what they require while supporting the expansion of your company.

It is an easy procedure. Fill out the online dealer application; once you’ve filed it, TD Retail Card Services will analyze it and, if it’s approved, send you all the supplies you need.

Please download and read the Enrollment Information Kit for more details on the Yard Card program.

Kindly fill out the form below and a representative will contact you if you have any further questions about the Yard Card program.

*As a reminder, the Yard Card program is only available to independent sellers of outdoor power equipment and related merchandise. The program is not open to landscapers.

Online applications are available for Yard Cards. Below are the processes for applying for the Yard Credit Card that you can use here:

Recommended: Activate Nordstrom credit card

How can I reset the password on my Yard Card?

Your Yard credit card account password can be reset in a few simple steps if you’ve forgotten it. Following are the instructions for changing the Yard Card password:

You can reset your Yard card login account password by following the instructions.

How to contact the Customer care service of Yard Card?

You can manage your account online, make payments, and get in touch with customer service using the details provided below if you have a Yard Card credit card. (Remember that TD Bank is the credit card provider for Yard Card. Customer assistance and payment processing are provided by TD Bank.

To make payments and modify your account, log in to your online account.

Help & Payment by Phone for Customer Service.

Call 888-382-6665 to make payments on credit cards issued by TD Bank and Yard Card.

Yard Card PO Box 100114 Columbia, SC 29202-3114 Credit Card Payment Address

Any questions you may have can be answered by giving a call at 1-800-538-3638.

The process to Request a Credit Limit Increase:

If you’re using a mobile device, you might want to think about requesting a credit limit increase online via EasyWeb or the TD app. You may receive the amount you asked for, a lesser amount, or they may reject your request altogether. They will inform you appropriately.

A request to raise the credit limit for a TD Credit Card Account may only be made by the Primary Cardholder, and the Account must be open and in good standing.

Make a request using EasyWeb Online Banking by signing up for it-

Make a request via the TD app-

Telephonic Request-

Your increased credit limit will appear in your Online banking profile within 2 business days of the receipt of your request, whether your request is approved or if you are approved for a lesser amount than requested.

Between 7 to 10 business days following the requested date, if your request is denied, they will mail you a written acknowledgment of this rejection to the address they have on file for you.

Trending: Activate Maurices Credit Card

To pay your TD Credit Card Account, you can arrange to have the minimum payment or the entire debt automatically deducted from your deposit account. Any financial institution accepts payments from checking and savings accounts.

How may funds be moved between accounts?

In just five easy steps, you can transfer money from one TD Account to your TD Credit Card.

After logging onto EasyWeb or the TD app, you may make the transfer online by selecting Transfers (you will be prompted to log in).

Your TD Points or Cash Back Dollars: How Are You Using Them?

A transaction on your TD Credit Card that you would like to dispute?

What to think about before a conflict begins? If you want to challenge a transaction on your TD Credit Card, check the following-

A purchase made using your TD Credit Card is necessary for filing a dispute. The charge may be fraudulent if you discover a transaction on your statement that is from a business you haven’t done business with. Please call TD Credit Cards at 1-800-983-8472 right away if you believe the transaction was fraudulent and it has already been posted to your account.

Please make an effort to settle a disagreement with the vendor directly if you have one regarding a purchase you made. You can fix your problem and also get a refund of your money once you’ve spoken with the retailer. However, proceed to the next step if you are unable to fix the issue directly with the seller.

They advise getting in touch with them within 30 days of the account statement’s Statement Period End Date, which is when the transaction or suspected error first appeared.

NOTE: Visa’s dispute network regulations place restrictions on their ability to bring a claim on your behalf.

How are credit card transaction disputes handled?

If you need any more information, they may contact you via SMS, email, mail, or phone. It is crucial that you call them back, in accordance with the appropriate payment network rules. They only have a brief window of time to carry on the dispute process on your behalf. If you don’t react by the deadline, they might have to close the dispute, reverse any credits they’ve given you, and revoke them.

Keep in mind, that an EasyWeb login is necessary, and register for EasyWeb online right away if you haven’t already.

Published On : January 31, 2023 by: Sakshi/Category(s) : Banking & Finance

Leave a Reply