navyfederal.org/activatedebit is your doorway to get your Navy Federal Credit Union Card activated. Navy Federal offers credit cards, deposit accounts, auto loans, home equity products, mortgage loans, investment products, insurance, and more. The company’s CEO is Mary McDuffie and its headquarters is in Vienna, Virginia, United States. The venture begin or was founded on13th March 1933. Till now, the clustered chain includes a number of locations and multiple employees.

Their credit union membership is open to anyone who lives, works worship, or attends school in the District of Columbia, its territories and possessions, and in the states of Maryland, Virginia, and North Carolina. Navy Federal is the world’s largest credit union. With more than 66 million members, Navy Federal offers competitive rates with personal service. They also offer competitive rates with personal service. So, without any further ado, let’s jump into the ocean of information about Federal Credit Union cards and their activation steps using navyfederal.org/activatedebit.

Table of Contents

In most situations, Navy Federal credit card acceptance requires a credit score of at least 700; this is considered “good” credit. The initial minimum deposit is the amount of money required to start an account at Navy Federal Credit Union. Typically, the fee ranges from $25 to $100, depending on the bank institution. When you join Navy Federal and open a savings account, you must make a $5 minimum deposit. Before applying for one of their cards, keep in mind that you must be a Navy Federal member.

The Navy Federal Credit Union nRewards® Secured Credit Card is the simplest Navy Federal card to obtain. You can qualify even if your credit score is 639 or below. You must be an NFCU member to apply for a Navy Federal Credit Union credit card. If you’re wondering which is better, USAA or Navy Federal? Then keep reading. Overall, Navy Federal Credit Union has lower interest rates than USAA. Furthermore, all of Navy Federal’s checking accounts earn a 0.05 percent annual percentage yield (APY), with the exception of the Flagship Checking Account, which yields between 0.35 percent and 0.45 percent, depending on your account amount. USAA’s checking accounts pay only 0.01 percent APY. But at the end of the day, the choice is yours to make!

Call Navy Federal Credit Union at 1-866-258-7298, Option 1, Monday through Friday, 8 a.m. to 5:30 p.m. EST to begin the claim process. A processing period is generally 4 days after all needed documents are received. That is how fast your Navy Federal card will be authorized. In terms of the card’s monthly fee, tiered dividends depending on balance (receive dividends with a daily ending balance of at least $1,500) Reimbursement of ATM fees with direct transfer (up to $120 per year) There is no monthly service charge if the average daily balance is $1,500 or more; $10 if the average daily balance is less than $1,500. Now let’s see how to activate the Navy Federal Credit Union via navyfederal.org/activatedebit.

NOTE: If you are not currently a Navy Fed member, you may be eligible to join even if you are not in the military. Navy Fed stated in February that it will be expanding its membership to accommodate veterans and their families. You are eligible to enlist if you have an immediate family member who has served in the military in the past.

Debit cards may be readily activated with three easy methods; via an app, online, or by calling an authorized contact number.

Using the Mobile App: Sign in to your Navy Federal mobile app, pick the checking account linked with your debit card, and then click the “manage card” option. Select “activate card” from the card management menu.

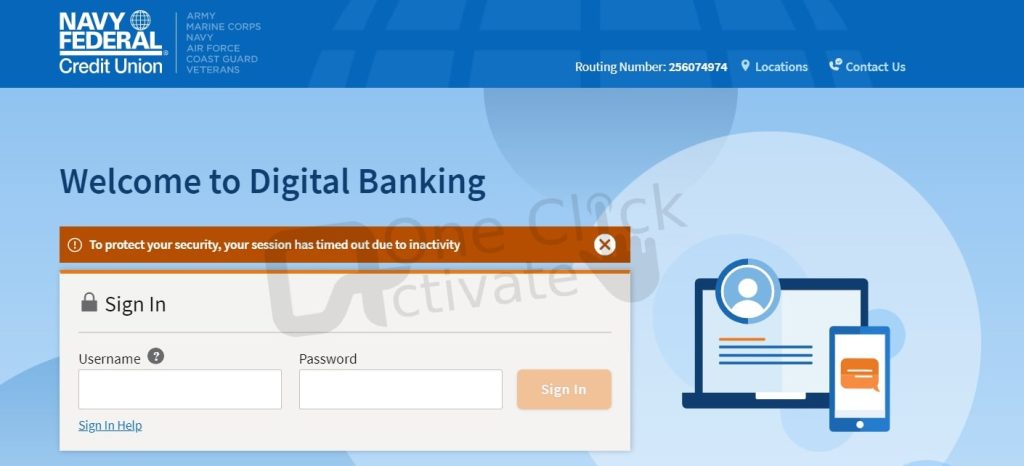

Online Banking Option via navyfederal.org/activatedebit: To activate your card, sign in to online banking using your credentials at navyfederal.org/activatedebit and go to the “account services” tab.

By Phone Call: 1-800-531-9561

If you are wondering how long does it takes to get a card then this one is for you! Card delivery timeframes will vary based on each country’s customs and postal service processes. It generally takes 7-10 business days to reach inside the United States. Regular mail can take 12 to 20 business days to reach APO, FPO, and other foreign locations.

Also, did you know? You can become a Navy Federal member if you have an immediate family member who has enlisted or is eligible to join. Grandparents, parents, spouses, siblings, grandkids, children (including adopted and stepchildren), and members of the household are examples of immediate relatives.

To Change Your PIN:

If you want to change your PIN, you may do it in the following ways:

Lost Or Expired Card?- Here’s What To Do!

Once you have successfully activated your Navy Federal Card using navyfederal.org/activatedebit and faced serious issues like a stolen, lost, or expired card. Then you can check out the instructions mentioned for your help below.

Debit cards may be issued quickly at any Navy Federal branch, both domestic and international. Cards are provided at the moment, activated, and ready to use. You may also request a new card by visiting their website or using our mobile app.

If you misplace your card, you can freeze it until you find it. Freezing a card does not indicate that your card has been lost or stolen, or that illegal transactions have occurred on your account. It’s an easy method to ensure that no transactions will be permitted until you locate your card. If you detect any fraudulent transactions or if your card is lost or stolen, please call 1-888-842-6328 immediately.

Before your existing debit card expires, Navy Federal Credit Union will automatically mail you a replacement card to your registered address. Please update your address by logging in to the Navy Federal app or visiting our website. The delivery date is determined by the postal service in your region.

NOTE: When you renew your debit card, your PIN will not change. You can use the same PIN you used on your prior card. However, if you want to set a new PIN, follow the steps outlined above for changing the PIN.

If you momentarily misplace your debit card, freeze it until you find it. Sign in to digital banking, choose your debit card, and then click “Freeze Card.” Once you’ve located your card, you may quickly unfreeze it.

The freezing of your card does not indicate that your card has been lost or stolen, or that illegal transactions have occurred on your account. It’s merely a means to certify that no transactions will be permitted until you locate your card. If your card is lost or stolen, or if you discover any illegal transactions, please contact 1-888-842-6328 right once.

Only recurring transactions are eligible for stop payments. If you want to put a stop payment on a recurring debit card transaction, call 1-888-842-6328, visit a branch, or send an e-Message through online Banking.

International purchases and ATM withdrawals are subject to a 1% charge for each transaction.

Mailing Fees Cost:

First Class USPS new or replacement card has no additional costs- Free

First Class USPS system-generated PIN doesn’t charge you- Free

The FedEx new or replacement card with self-selected PIN costs- $11.50

For UPS, PIN only you have to pay- $5.95

Magnetic-stripe cards are substantially less secure than contactless cards.

Yes, you may securely keep your Navy Federal Debit Card and use it to make purchases in-store or online with Apple Pay, Google Pay, or Samsung Pay.

Contactless debit cards are ideal for quick transactions, such as those made at a coffee shop or when boarding a train.

– Look for a contactless indication on your debit card and search for the emblem on the store’s checkout terminal.

– Bring your card within a few inches of the contactless icon when asked.

– Go: You’ll hear an “okay” beep, see a checkmark or a green light, and then you’re free to go!

Yes, your Navy Federal Debit Card number is not kept on your phone or provided to the merchant when you use a mobile wallet. A one-of-a-kind digital code is generated just for that gadget. You also enjoy the security of our Zero Liability policy, which guarantees that you will not lose any money due to illegal charges.

Yes, try inserting or swiping your chip as directed by the merchant’s terminal.

You may arrange your trip using our mobile app or online banking. Please let us know the dates you’ll be traveling and where you’ll be traveling, including any layovers.

By entering your PIN and requesting cash back, you may instantly earn cash back at participating retailers.

Point-of-sale and ATM transactions in foreign countries are subject to a 1% charge for each transaction.

Automatic transaction alerts are an excellent method to remain informed and secure your account. Sign up to get notifications about debit card purchases or recurring payments. Sign in to your online account, then click the “Account Services” page, then “Sign Up for Account Notifications,” and then “Cards” under the “Notifications” tab.

Published On : February 23, 2022 by: Sakshi Sharma/Category(s) : Banking & Finance

Leave a Reply