Did you recently receive your Emerald Card by H&R? Are you confused about its login process? Worry not, we are here to help. In this guide, we will tell you all about the Emerald Card by H&R Block, its various features, along with its login and activation process. So, what are you waiting for? Hop on with us for the ride.

About Emerald Card by H&R Block:

For customers who desire the ease of using a card for purchases but don’t want (or don’t qualify for) a standard credit card, H&R Block has created the Prepaid Emerald Mastercard. The only money that is already in your account can be spent using prepaid cards, in order to save money on interest payments, returned checks, and overdraft fees.

The H&R Block Prepaid Emerald Mastercard does not conduct a credit check, ensuring acceptance. However, it won’t benefit your credit-building efforts, and some internet retailers do not accept prepaid cards. For existing H&R Block clients who prefer not to have their tax refund deposited into their bank account, the H&R Block Emerald Prepaid Card is the ideal option. It provides bill payment through a mobile app, no overdraft fees, and more. Furthermore, even after utilizing your refund, you can still use the card.

However, keep an eye out for costs that might deplete your funds. A standard bank account can be a better choice if you already have one and don’t mind waiting to get your return.

Table of Contents

The H&R Block Emerald Prepaid Mastercard is only available online or in H&R Block locations while you are filing your taxes using H&R’s software. Where to locate the closest H&R Block:

What are the eligibility criteria for an Emerald Card by H&R Block?

Eligibility:

Your H&R Block Emerald Prepaid Mastercard will get approved if you are:

Required details:

Before registering your card online, be prepared with the following:

Pros of Emerald Card by H&R Block:

Cons of Emerald Card by H&R Block:

There are a few disadvantages to the H&R Block Emerald Prepaid Mastercard that you should be aware of:

What to do after receiving my H&R Block Emerald Card?

To get the most out of your new card, use all of its capabilities.

Follow the steps below to activate your Emerald Card by H&R Block:

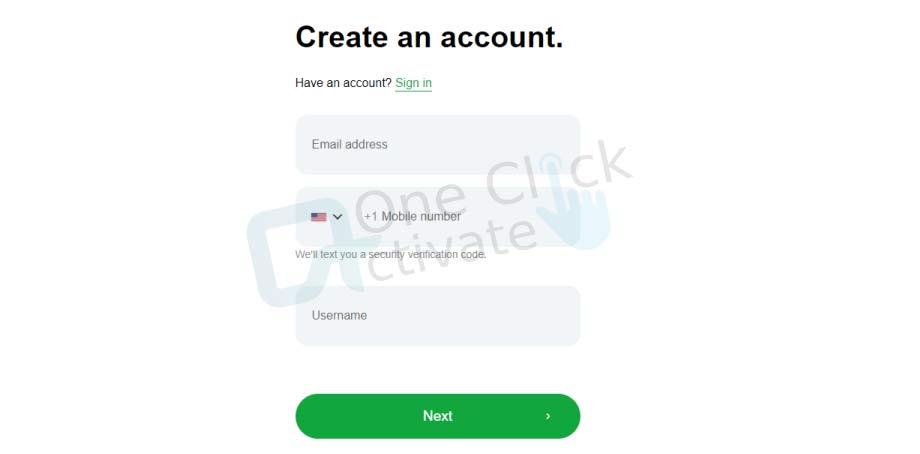

You should create an account so that you may maintain your card in addition to activating it. On the Emerald Card login screen, you can accomplish this. Once you’re set-up, you can check your balance, make payments, and move money across other Emerald accounts in addition to seeing your transaction history.

However, if you want to manage your card often, you can prefer using the app to frequently visit the HRBlock.com Emerald Card website. The MyBlock mobile app is available on Google Play and the iTunes App Store. You won’t need to remember a password if you use the app to log in via touch and face recognition.

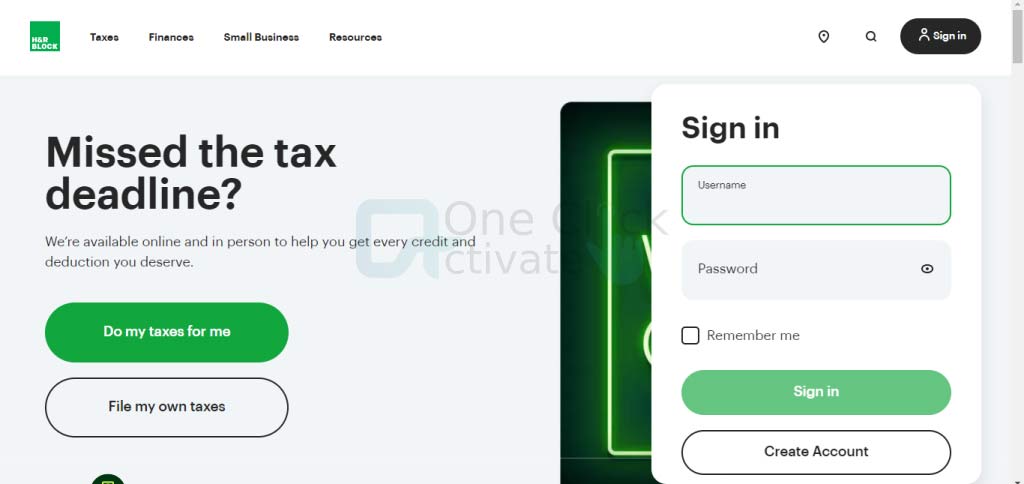

Follow the instruction below to log into your H&R Block Emerald Mastercard account:

How can I refill the Emerald H&R Block card?

You may use your HRBlock.com Emerald Card for more purposes other than only getting your tax return when you sign up for one. You can keep adding money from sources like paychecks, government benefits, cash, and checks. By having the option of direct deposit, you may avoid having to use a fee-based service to cash your check and save money. Your choices for financing include:

How can I get copies of my H&R Block Emerald card’s transactions and statements?

There are three free methods to get access to the last 12 months’ worth of transactions:

Customer Service for Cardholders PO Box 10170

Emerald H&R Block Advance:

Despite how useful the Emerald Card can be, you cannot receive a refund right away. H&R Block provides the Emerald Advance Line of Credit in exchange for it. With this option, you get a line of credit in the range of $350 to $1,000, depending on the size of your expected return. Although there could be better choices, this service has a $45 yearly cost and a 36 percent annual interest rate.

Only a small window of time each year is available for applications for the Emerald Advance Line of Credit. The exact dates vary each year and take place between November and January. To apply for the program, you must go to an H&R Block office that is a participant.

Once authorized, you can utilize your credit line and make payments equal to the higher of $25 per month or 4% of the outstanding debt. You’ll be eligible to utilize your credit line all year long provided you pay off your amount by February 15th.

Conclusion: So, that was all about Emerald Card by H&R Block, and its activation and login procedure. And if you follow all the instructions carefully, you will be able to log in and activate your card in no time. With this, we come to the end of our article and hope that your will like our content. Furthermore, please don’t forget to leave your valuable feedback in the empty space below.

Frequently Asked Questions (FAQs):

After your account has been approved, your card should be sent in the mail in seven to ten business days.

Yes. Due to a recently broadened definition of government benefits, the (CFPB) Consumer Financial Protection Bureau said on April 13 that taxpayers can now get their stimulus checks using prepaid cards. Your stimulus payment should be delivered to the H&R Block Emerald card if you used it to get your most recent tax return. On the IRS website, you may see the status of your payments.

Yes. A secondary user can apply for a customized card via your account online or in person at an H&R Block store. Equal ownership of the account will be shared by the joint owners.

As soon as you notice that your card is missing, contact customer care. If someone uses your card without your permission and you report the loss to customer support within two business days, you are only responsible for the first $50 charged.

Published On : June 30, 2022 by: Anjali Latwal/Category(s) : Trending

Leave a Reply