The covid-19 pandemic has got us huge social, economic, and health losses. Many businesses were at a halt and numerous dreams remained unfulfilled. But with getrefunds.com, Billions got Back to their Corporations. Businesses are empowered by Innovation Refunds! The majority of their team consists of “Big Five” accountants and attorneys who follow the same process as Fortune 500 businesses. They put up a turnkey package with all the required documentation. The success rate is 100% and there are no upfront expenditures. Its value derives from its extensive network of business partners, financial institutions, cutting-edge technology resources, and reliable consultants. Innovation Refunds is co-owned by more than 100 banks like Community bank, Core bank, First Fed, Sunwest Bank, Insbank, Tioga State Bank, Johnson Financial Group, Five Star Bank, and counting.

With our guide, getting payroll tax refunds via Innovation refunds is a matter of minutes now! Let us begin.

ERC is a payroll tax credit that is refundable. Its goal, derived from the same CARES Act as PPP, is to provide economic relief to small and medium-sized businesses that retained employees during the COVID-19 pandemic. Initially, eligible employers could only choose between PPP and ERC. This provision was amended in 2021 as part of the Consolidated Appropriations Act, allowing businesses to apply for both.

Table of Contents

Because of the COVID-19 pandemic, Section 3134 of the Internal Revenue Code has been modified. This section limits the Employee Retention Credit to just salaries earned before October 1, 2021, unless the employer is a recovery starting a business. Wages (including some health plan expenses) for each employee up to $10,000 can be used to calculate the 50% credit. Many struggling employers can receive this benefit by decreasing incoming contributions or asking for an advance credit on Form 7200, Advance of Employer Credits Due to COVID-19 because it can be applied to wages previously paid after March 12, 2020.

If you’re wondering how ERC differs from the Paycheck Protection Program (PPP), we’ll put it simply: PPP was a forgivable loan. ERC reimburses your company for payroll taxes already paid. There is no further action required on your part once you receive the ERC funds from the US Treasury.

The SBA heavily promoted PPP, whereas ERC is claimed directly through the US Treasury. It is their mission, in collaboration with their bank partners, to educate you and obtain for your company the payroll tax refund to which it is entitled. There are over 70,000 pages of tax code; being an expert on all of them is impossible. They only do ERC. It’s similar to the distinction between a family doctor and a neurologist. They understand the complexities and nuances involved in determining your eligibility and accurately calculating your refunds because they focus solely on this program.

Recommended: SoFi Money Activation Guide

The Internal Revenue Service is the revenue service for the United States federal government, in charge of collecting taxes and enforcing the Internal Revenue Code, the main body of federal statutory tax law.

The IRS anticipates that 70-80% of small and medium-sized businesses will qualify. You qualify if your company experienced disruptions in commerce, travel, or group meetings! Supply chain disruptions, price increases, staffing shortages, difficulty hiring, reduced hours, reduction in goods or services offered, and inability to travel or attend conventions are all examples. To learn more, contact one of their Refund Specialists.

Because the program has technically expired, time is of the essence. You only have a limited amount of time to recover the money that is rightfully yours. The program is subject to the whims of Congress and could run out of allocated funds at any time. Don’t put it off!

Your Employer Retention Credit is a payroll tax refund that you do not have to repay. It’s YOUR cash! There are no restrictions on how you can use it, but there are some limitations to ERC that you can read about below.

A refundable tax credit equivalent to 50% of the authorized wages an eligible firm pays to employees after March 12, 2020, but before January 1, 2021, is known as the Employee Retention Credit and can be used to offset certain employment taxes. By lowering the employment tax deposits they would otherwise be forced to make, eligible companies can get the benefit right away. Additionally, if the employer’s employment tax payments fall short of covering the credit, the IRS may advance the employer’s money.

Employers, along with tax-exempt organizations, are qualified for the credit if they continue operating a trade or business in 2020 and encounter either of the following:

Gross receipts begin to fall abruptly:

The end of a significant decline in gross receipts:

Also Read: Apply At Fastest-Growing Mortgage Bankers-American Financial Network

Their leadership team has walked in your shoes as business owners and long-term managers, building start-up companies into multimillion-dollar operations and turning troubled businesses into profit centers, among other things. The dangers and benefits of achievement are nothing new to them.

Their CPAs and attorneys are top-tier authorities on tax law, compliance, and credits and refunds for research and development. They have put together a team with a variety of experiences from MIT, Fordham, Georgetown, Leeds, Deloitte, Price Waterhouse, and other illustrious institutions, which has resulted in a 100 percent success rate for their clientele.

Their software guides you through your study utilizing a set of clear instructions and does on-the-fly credit calculations. They are aware of the regulations and adhere to them. coordination with your team and tax experts, to IRS compliance.

Your business has grown as a result of a lot of time, effort, and sweat equity on your part. Furthermore, they think you are the foundation of America’s economy, jobs, and future economic progress. They admire you for that. Every suggestion they make gets treatment just as carefully as if it were their own business.

Here are the Indices that You Qualify for a Payroll Tax Refund:

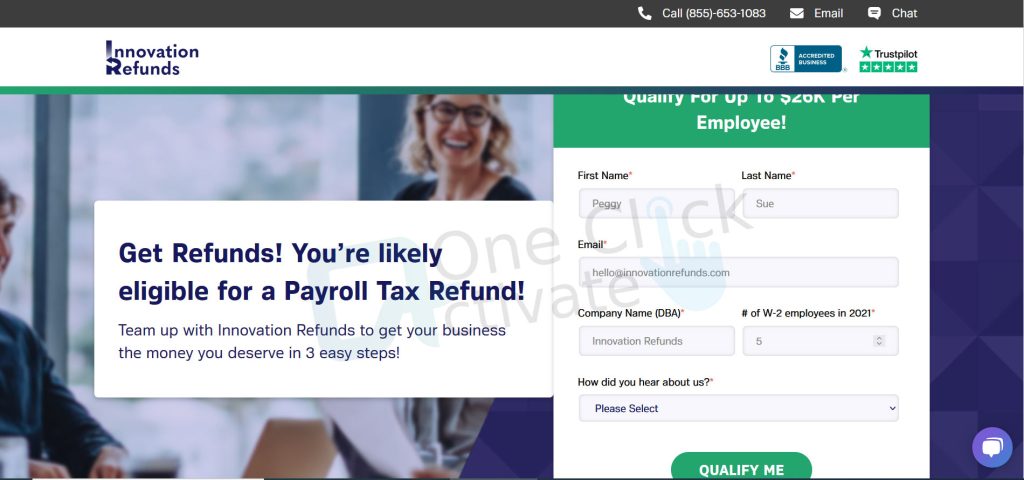

You most likely qualify for a refund of payroll taxes! You can get up to $26K per employee by doing the below tasks:

Work with Innovation Refunds to acquire the money you need for your company in 3 simple steps!

Step 1: Finish your application to reserve a spot in line in less than 12 minutes. To complete the application process, you need to provide the following details:

Click on the green tab prompting: “Qualify me” and the process completes here!

Step 2: Submit supporting paperwork to their top-tier CPAs so they can prepare and submit your claim for a refund.

Step 3: Collect cash payments from the US Treasury for up to $26,000 per employee!

Teach your Kids about Money & Investment with our GoHenry Card Account guide

Regency West 8

4350 Westown Pkwy Ste 300

West Des Moines, IA 50266

The following additional credit and relief provisions may have an impact on an eligible employer’s ability to claim the employee retention credit:

Frequently Asked Questions (FAQs):-

Absolutely! Both essential and non-essential businesses can qualify, and no revenue decline is required. Many of their clients experienced sales increases while still experiencing disruptions or being negatively impacted.

To receive your refund analysis, there are no upfront fees or obligations. Once the company is engaged to recover your refunds, their fee is 25% with no hidden costs. You will never have to pay their fee out of pocket. They are only paid when you receive your refund checks. The fee includes expert CPA or Tax Attorney preparation of your claims who specializes in qualifying, substantiating, calculating, and claiming ERC refunds.

Within 30 days of receiving your documents, they’ll finish the process. Depending on the backlog, you will get refund cheques from the US Treasury in 5 to 8 months. It will take longer the longer you wait!

Calculating the correct amount to which you are entitled involves a challenging accounting process. Despite the fact that they are payroll tax credits, your ERC calculations are unaffected by the amount of payroll tax you have paid. Refunds are determined by a number of variables, such as the number of qualifying quarters, the number of employees, the hours worked, the wages paid, and, if applicable, PPP loans, group health payments, and participation in other government programs.

Published On : July 12, 2022 by: Sakshi/Category(s) : Trending

Leave a Reply