If you’re a small business owner in need of quick and easy access to capital, Fora Financial may be a good option for you. The online lender offers merchant cash advances (MCAs) and term loans, both of which can provide you with the funding you need to keep your business running. However, to avail yourself of all that it offers, you’ll have to Activate your Fora Financial account and log in to it.

The downside of Fora Financial is that the interest rates on their loans are higher than average. So if you’re looking for a low-cost loan, you may want to look elsewhere. But if you need quick access to capital and flexible repayment terms, Fora Financial can be a good option for your small business. In our guide, you can know about Fora financial reviews, Fora financial PPP letters, Fora financial login, Fora financial letters, and what not? So, let us get started now!

Handpicked Relevant Content: Activate Fintwist Card with Activation code over the Phone

Table of Contents

To begin the account activation procedure, identify your 8-digit ForaFinancial personal Activation code on your letter and proceed as follows:

Editor’s Recommendation: How to complete Coles Card Activation Process?

Small business owners know the time and attention it takes to run day-to-day operations, market their business, and analyze new customers. That’s why Fora Financial is here with reliable financing for your small business. Whether you need working capital or prefer to pay bills on time, Fora Financial offers flexible terms and quick funding on the spot.

It is critical that you make sound financial decisions as a small business owner. Follow the procedures on this page when applying for a business loan. You’ll be more inclined to qualify for a loan and know you’ve chosen the finest option for your company. We hope you liked this post, thank you for being with us!

If you have a short-term loan, you will make daily or weekly installments, however, a merchant cash advance will require daily payments. However, if you can repay your short-term loan ahead of schedule, you will not be subject to prepayment penalties with Fora Financial.

Loan Forgiveness & Deferment: This financing option is forgiven for amounts spent on permitted uses of funds during the 8 weeks following funds receipt.

To Get Approval: Provide three most recent bank statements for your business, Fora Financial’s one-page application, a driver’s license, a voided check, your credit score, and proof of business ownership. You may also be required to provide tax returns and financial statements. The origination cost is 2.5%.

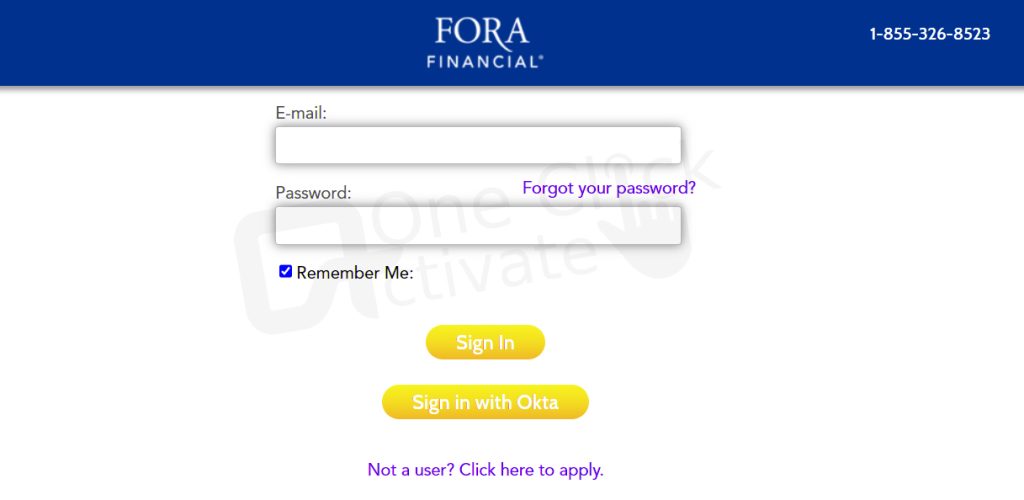

Simple Instructions for Activating Your Fora Financial Account at forafinancial.com/activate:

>Visit https://www.forafinancial.com/activate/ to get started.

>To access your offers, you will need your personal activation code.

>Lookup Activation Code is the option.

>When the Code is right, the account will be activated.

As per Forbes Advisor, Fora Financial has scored a 3.0 rating out of 5. And here are the honest Fora financial reviews:-

Fora Financial is ideal for entrepreneurs who:

>Short payback terms are possible. Fora Financial term loans have a maximum repayment length of 15 months, which is much shorter than other company loans.

>Sales have been erratic. Businesses with changing sales month to month may find it easier to satisfy payment requirements because MCAs take a percentage of your sales rather than a fixed monthly payment.

Fora Financial may not be the best option for business owners who:

>If you’re looking for a long-term loan. Many firms lack the cash flow to repay a loan fast. If you require more flexible payment choices, you should seek out another lender.

>Fora Financial loans are not available to businesses that have declared bankruptcy.

>There aren’t enough sales. If your company does not fulfill the monthly credit card sales gross ($5,000) or revenue criterion ($12,000), it will not be eligible for a Fora Financial loan.

When you regard the PPP loan as a debt, it is recorded on your balance sheet as a financial liability (with interest accruing). The SBA payment should be recorded as a cash inflow from financing activities. The IFR exempts PPP debtors of $50,000 or less from any decreases in forgiveness based on: cutbacks in full-time-equivalent (FTE) employees; and reductions in employee salaries or wages.

Your lender is responsible for alerting you of the SBA forgiveness amount and the date your first payment is due, if applicable. Borrowers who require direct forgiveness help should call the SBA’s dedicated forgiveness phone center at 877-552-2692. The forgiveness of PPP loan profits should be recognized as a distinct line item in income from continuing operations.

Published On : January 4, 2023 by: Sakshi Sharma/Category(s) : Banking & Finance

Leave a Reply