If you have been thinking about getting a credit card to build or repair your credit score, we recommend you apply for the First Savings credit card. Our guide will help you with the First Savings Credit Card activation. The card reports to all three major credit bureaus and does not require a security deposit or an annual fee. However, obtaining this card is tricky since you need an invitation to do so. Also, the higher fees may put you off.

This First Savings credit card offers a unique way to build or repair your credit. Because it reports to all three major credit bureaus and does not require a security deposit, it’s a great option if you want to improve your credit standing. But there are some drawbacks like higher fees. That may make other cards more attractive options for those with limited income or bad credit. Are you ready to begin now?

About the services:

The First Savings Credit Card is a great credit card for those who have poor or fair credit and are looking to repair or build their score. This card reports to all three major credit bureaus, so you can track your progress. You can also choose not to accept the higher APR and annual fees by making payments on time each month. As for the application process, you’ll need an invitation from First Savings Bank. But once you have that in hand all you need is proof of income and a checking account.

First Savings Credit Card, issued by WebBank and serviced by Synchrony Bank, is a secured credit card. It will help you repair or build your credit. With no security deposit required and reports to all three major credit bureaus, it’s the smart choice for people with limited credit history.

So, the First Savings Credit Card is a great option for you if you have got a low or no credit history since it reports to all three major credit bureaus. With this card, you can rebuild your credit score while earning cashback with your first purchase and enjoying no annual fee. But keep in mind that the higher fees may deter other borrowers from looking for more affordable options.

Also Read: Activate ReleasePay Card Online

Table of Contents

Fees-

Account Management-

You may manage your account online with the First Savings app. You could also use the app to check your account balance, make payments, amend your bank details, and enroll in autopay.

Interest Rate-

As previously stated, First Savings charges an annual percentage rate (APR) based on the deal you qualify for. Your APR varies depending on your creditworthiness. If you have a low or poor credit score, you should expect to pay a higher APR and annual cost.

Application Process-

Applying for the First Savings credit card is a time-consuming procedure. To apply for the card, you must be invited. However, once you’ve received the invitation email, the remainder of the procedure is rather straightforward.

Moreover, First Savings does not mention what credit score is required to qualify. However, if you receive an email invitation, it signifies your credit score was good enough to qualify.

Does your credit history need a little help? The First Savings Credit Card is a good option for individuals who are trying to repair their credit or build it from scratch. The benefits of this card include the opportunity to build and maintain a good credit score without the need for a security deposit and the ability to compare your creditworthiness in real-time with other borrowers. However, this card does have high fees so be sure you carefully review its terms before applying. And if you have made up your mind then let’s begin its application process!

You must have received an email invitation to apply for the First Savings credit card. Once you’ve received this email, go to the First Savings website and click the green “Accept Online” option on the homepage.

You’ll be asked to enter your reservation number and access code. Both of these numbers are included in the invitation package. There’s also a visual on the website to assist you to find these numbers on the invite message.

The website will direct you to the credit card application page once you enter these digits. Fill in the blanks on the screen with your private details, monthly income, and employment status. The time it will take for your application to be granted is not specified by First Savings. In most cases, credit card companies execute authorization immediately. It’s possible that the procedure will take a week or more.

Recommended: Activate MyPrepaidCenter Card

The First Savings credit card is designed for folks who are just getting started with their finances or who want to enhance their credit scores. With each payment, First Savings sends a report to the major credit bureaus, assisting you in improving your credit score.

Second, it is an excellent alternative for those who do not want to use a secured credit card. A security deposit is required to obtain a secured credit card in the event that you default on payments.

While the First Savings credit card is a fantastic option for credit building and credit restoration, the annual fees and APR should be reduced to make it even more appealing. Additionally, for application, an invitation email is necessary, which may be a barrier for some.

However, if you accept the invitation and are willing to pay the annual fee, the First Savings credit card can help you get back on track quickly.

How does the Payment of Bills take place?

You can pay your credit card bill in a variety of ways with First Savings. Or you can pay your bill via the services portal using your online account. You can also send your payments to the address provided below:

First Savings Credit Card

P.O. Box 2509

Omaha, NE 68103-2509

Phone payments, Western Union, and MoneyGram are also accepted at First Savings.

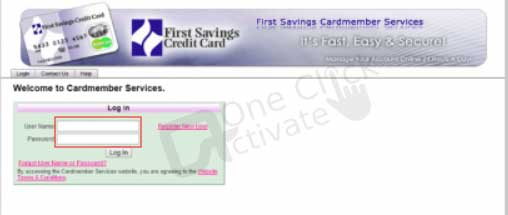

Login process-

Users can access account summaries, sign up for SMS and email notifications, set automated payments, and manage their accounts after logging in.

Trending: Activate Revolve Card

Convenience- People with less-than-perfect credit will appreciate the convenience of this credit card. Making payments with a credit card is the most convenient option. Its usefulness stems from the fact that it may be used to make large purchases, whether online or in a physical store.

Security- The First Savings Bank credit card is fortified with extra security to protect you against potential fraud. There is no possibility for you to fall victim to a fraudster as long as you protect your account details.

Assisting in Building Credit- With frequent use and payments, you can rebuild your credit after acquiring the credit card. The creditworthiness you establish will undoubtedly result in higher credit scores later. Your prospects of qualifying for larger financial products in the future will be improved if you have a good credit score.

Acceptance by many People- You ought to be able to pay for transactions made from a variety of merchants using a First Savings Credit Card. Don’t be concerned about the embarrassment of having your card denied. This is, after all, a MasterCard!

Understandable Costs- Did you know that the fees levied by this credit card are rather straightforward? There seem to be no hidden fees, and the user knows exactly what to expect right away. Other credit cards for first-time users aren’t as good.

People with no credit history are also eligible- The nicest thing about the First Savings Credit Card is that it is available to folks with bad credit. This gives such people access to the financial world. One can create a credit history for future use after a series of consistent credit card usage.

Several Alternatives- To fulfill the demands of each individual, the First Savings Credit Card offers a variety of options with unique conditions and features.

Published On : June 14, 2022 by: Sakshi/Category(s) : Banking & Finance

Leave a Reply