Students have always been seeking methods to push their money as far as they can. When you’re just getting started with your finances, you’ll take advantage of whatever extra help you can get to get more bang for your buck. That’s why seeing fantastic credit card benefits might be tempting. Unfortunately, because they demand great credit, many of the top rewards credit cards are not available to students. While student cards are easy to obtain, many of them offer little to no benefits. You don’t have to pick with the Chase Freedom Student credit card. You may have a card that charges and gives you valuable rewards without having to have a significant credit history. To get started with the service of credit Let’s explore what the Chase Freedom Student has to offer in more detail.

Table of Contents

To take advantage of the benefits, you won’t need to invest a lot of money.

It’s fairly unusual to see greater welcome incentives with other cards that are only accessible if you spend thousands of dollars during the first three months. The Chase Freedom Student credit card, on the other hand, is unique. To qualify for the $50 incentive, you simply need to make one purchase during the first three months.

Useful Topic: Activate Discover Credit Card

Every purchase made with the Chase Freedom Student credit card gives you 1% cashback. There is no time limit on the rewards. As long as your account is open, you may use the cashback. Furthermore, there are no minimum requirements to fulfill before you may pay out your points.

It’s worth noting that the cashback you’ll get will be in the manner of Chase Ultimate Rewards points rather than cash. As a result, you’ll have a wide range of redemption possibilities. You may spend your points to shop at Amazon, buy gift cards, or book travel through the Chase Ultimate Rewards® platform in addition to cash redemptions.

Whether or whether you gain any benefits for doing so, keeping your account in good standing is critical. After all, maintaining a strong payment history can help you enhance your credit score.

However, if you keep your Chase Freedom® Student account in good standing for another year, you’ll get a $20 incentive (for a maximum of five years). “Good standing” implies you’ve maintained your account open and in good standing for the whole year.

With the Chase Freedom® Student credit card, there is no annual fee. You may, however, be charged additional costs. A 3% international transaction fee, a late payment cost of up to $40, and a cash advance fee of $10 or 5% of the amount are among them (whichever is greater).

You should also keep an eye on the interest rate linked with this card. The variable APR is now 14.99 percent, and there is no introductory APR term. If you do decide to acquire this card, we recommend paying off your debt every month to prevent interest costs.

All of the normal security features are included with the Chase Freedom® Student card. These characteristics include:

There is no protection against responsibility. Unauthorized charges will not be your responsibility.

Protect yourself by purchasing insurance. Your new goods will be protected for up to $500 in damage or theft for 120 days.

Protection against fraud. Chase will assist you in keeping an eye on the account for any signs of fraud.

It has a lock function. Within the Chase mobile app or on the internet, you may quickly freeze the card against new purchases.

The Chase Freedom Student Credit Card isn’t the only credit card developed specifically for students. Although this card has good rewards and minimal fees, you might be able to get a greater reward selection with another student card. Check out the chart below for a quick comparison of the two best student cards from our selection.

| Card name | Chase Freedom credit card | Deserve EDU Mastercard | Bank of America Customized cash rewards credit card |

| Annual fee | $0 | $0 | $0 |

| Rewards rate | 1% off on all purchasesLyft is offering a 5% discount till March 2022. | 1% off on all purchases | 3% on a category of your choosing2 percent in supermarkets1% tax on everything else |

| Regular APR | 14.99% | 18.74% | 13.99% |

| Intro APR | N/A | N/A | 0% for 15 months |

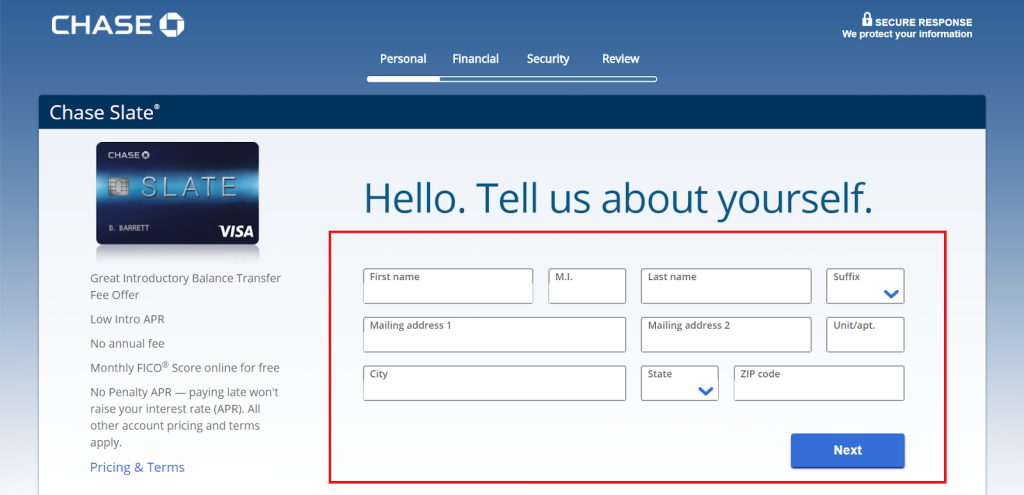

In order to apply for the Chase Freedom credit card, visit this official website- chasefreedomcreditcard. Now follow these steps mentioned below-

| Annual fee | $0 |

| Regular APR | 14.99% variable APR |

| Intro APR | N/A |

| Cash Back Reards | On all purchases, you’ll get 1% back.Purchases made instantaneously within the Chase mobile app or on the website will earn you 5% back on Lyft trips through March 2022. |

| Redemption options | Cash Shop with points at Amazon Gift cards Travel |

| Minimum cash redemption | $0.01 |

| Sign up bonus | $50 — if you make your first purchase in the first three months. |

| Good standing rewards | After each account anniversary, up to a total of five years, you will get $20. |

| Purchase protection | Damage and theft coverage for new purchases is up to $500 per claim and $50,000 per account (for up to 120 days) |

| Extended warranty protection | Increases the manufacturer’s guarantee by one year (on eligible warranties of less than three years) |

| Trip cancellation insurance | $6,000 per trip and up to $1,500 per person |

| Good standing rewards | After each account anniversary, up to a maximum of five years, you will get $20. |

| Balance transfer fee | $5, or 5% of the total amount transferred (whichever is greater) |

| Foreign transaction fee | 3% |

| Cash advance fee | $10 or 5% |

| Late or returned payment fee | Up to $40 |

| Credit score access | Yes |

If your credit card needs to be activated, you could have several options, such as contacting your credit issuer or installing the credit company’s mobile app. Let’s first get into the activation process of your credit card.

Within minutes, you may verify or activate your card using one of two typical methods:

On your credit card, search for a sticker with instructions on how to activate your card. You can call the toll-free number to activate the credit card. Further, you will be following the instructions of an automated operator. In order to complete the activation procedure, you can be asked to get the card information or a secured PIN.

The sticker present on your card encompasses a secured website link that will activate your card. Once you’ve arrived at the website, you’ll be given instructions to follow, which may involve validating your credit card information and answering security questions.

The Chase Freedom card is no longer accessible to new applicants, although comparable cards such as the Flex and Unlimited provide almost identical advantages.

You can apply for any of the cards, the new Chase Freedom Flex℠ or the Chase Freedom Unlimited®, at any time as a new applicant. The main question is what are the features these two cards have? The Freedom Flex card comes with much the same base benefits as the Freedom card, plus 5% cashback on travel scheduled through the Chase Ultimate Rewards® platform and 3% cashback on eating at restaurants and pharmacy shops. With Flex, you may earn extra cashback thanks to the additional perks. Freedom Unlimited does away with the bonus categories in favor of a simple 5 percent cash back on travel bought through Chase Ultimate Rewards, 3 percent on eating at restaurants, and 1.5 percent on all other eligible purchases. If you’re searching for a passive rewards program that doesn’t need any activation, these are excellent rates.

So, do you think the Chase Freedom card’s features are right for you?

The Chase Freedom credit card is a good option in general. The Chase Freedom credit card will likely satisfy the majority of folks who merely desire a credit card for daily expenditures.

If you have good credit, prefer high-end features, or spend a lot of time traveling overseas, you might want to choose a different cash-back credit card. Regardless of the fact that the Chase Freedom card is no longer accepting new applications, current users may still take advantage of all of the card’s advantages. However, if you want to change to a different Freedom card and don’t mind foregoing a bonus, the Chase Freedom Flex or Freedom Unlimited are also fantastic options.

Published On : November 8, 2021 by: Miti Sharma/Category(s) : Banking & Finance

Leave a Reply