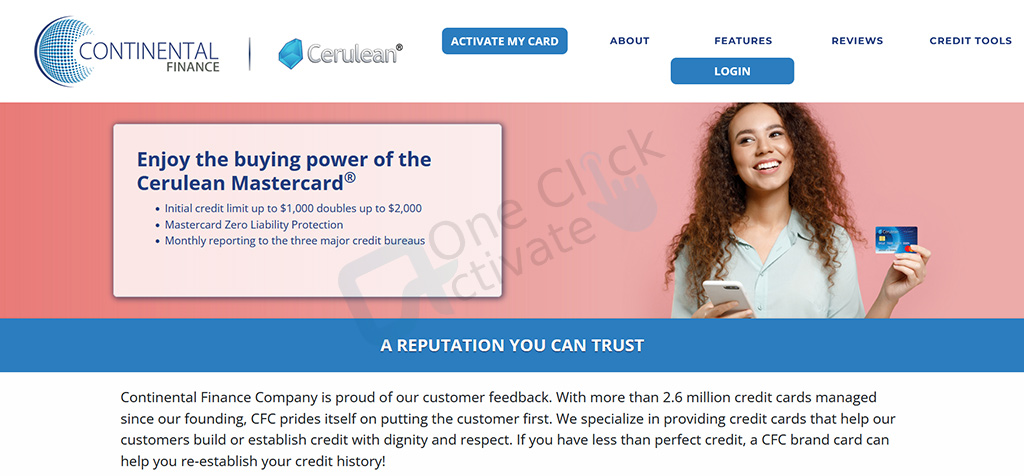

Everything from purchasing homes and automobiles to getting your rental application accepted depends on having good credit. Getting accepted for a low-credit, low-risk credit card is a simplest and quickest way to repair less-than-perfect credit. A solid credit card alternative for people looking to increase their credit score is Cerulean. In this article, you will be acknowledging the major processes involved, such as login, registration, and payment of Cerulean card.

Since it provides all relevant data on Cerulean credit cards, this article is crucial for users of Cerulean credit cards. Consequently, attentively read the entire essay.

Table of Contents

When you open a new account, you gain the following benefits-

Prices and Costs-

Once you’ve created an online account and registered on the official website, you can easily log into your card account on the online platform, do various card tasks there, and utilize the special tools and features that are made available there whenever and wherever you like. You must: in order to access your online card account.

Here are a few alternatives to Cerulean card: Discover Credit Card

Recover Cerulean login data-

You’re having issues logging in or you’ve forgotten your credit card’s login information. After that, follow the instructions below to recover your username and password so you may access your account once more.

Forgot Username? Enter the last four digits of your SSN, zip code, or date of birth to get your login credentials back. If you are still unable to access it, request assistance from a customer service agent.

Customers who don’t have enough credit can also use the Cerulean card, which will assist them to improve their credit. Only individual clients who are invited to join will be able to use this unique card. You might want to take a few actions to begin the online application if you are eligible.

Applicants will receive a decision right away after submitting their application. However, it can take a full 30 days to gather additional information before they decide whether to accept you. Once your application has been accepted, you will be required to pay a fair processing fee in order to receive your card and other documentation in the mail within a few business days.

You have one month to activate the card after you receive it. To increase security, you cannot activate your card over an online platform. Call the card’s activation number to get that information. Your new Cerulean Mastercard comes with a sticker that has the toll-free number printed on it.

Recommended: Login to Wayfair Mastercard

For Cerulean credit cards, assistance, and phone payment-

There are various methods you can boost your Cerulean credit limit on your own if you need to. They consist of-

By paying your bills on time, maintaining a low credit card balance, and continuing to pay down any existing debt, you can boost your chances of getting a credit limit increase.

Published On : September 21, 2022 by: Miti Sharma/Category(s) : Banking & Finance

Leave a Reply