This article lists how to cancel your Experian Subscription as well as of some loved ones who recently passed away. So, keep reading for it.

If you have ever signed up for an Experian subscription, even if it was for the free 30-day trial, there is a possibility that you are now paying for a service that you are not using. The typical American spends roughly $240 per month on subscription services, the majority of which they either have forgotten about or don’t make use of. These subscriptions may include not just leisure and business-related services, but also financial services such as credit monitoring.

It’s possible that you won’t even notice a very little monthly fee from Experian for months or even years. And even that seemingly little sum may easily add up to dozens or even hundreds of dollars. If you are responsible for the accounts of a loved one who has passed away, you may be required to continue paying the monthly fees associated with their subscriptions.

In this piece, we will take you step-by-step through the process of how to cancel your Experian subscription as well as that of a loved one who has just gone away.

Table of Contents

To begin, let’s have a look at how you can cancel your own Experian subscription in the event that you no longer want the service in question.

Step 1: First thing you need to do is switch over to the free version of your subscription.

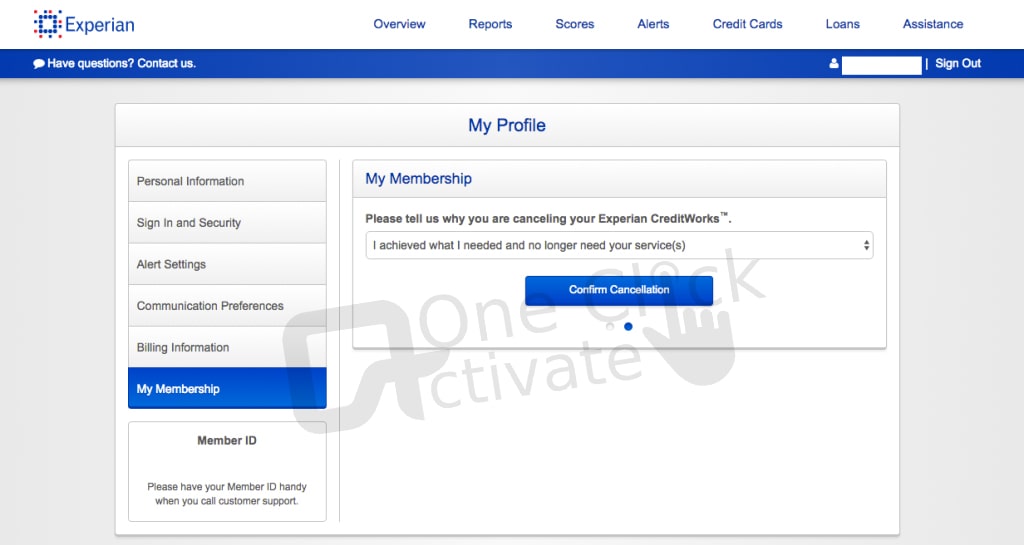

Logging into the online version of your Experian account and navigating to the membership settings will allow you to perform what needs to be done.

Bear in mind that the time it takes to complete this procedure might be longer, as was noted before. In addition, depending on the specifics of your account, you may be required to contact customer service regardless.

Also Read: Cancel Venmo Payment & request your money back

Step 3: Communicate with a customer support agent.

Contacting their customer support is the next step.

Step 4: Give them some information about your account.

If you phone the Experian Customer Service line or send an email to the company, you should be prepared to supply information about your personal profile in addition to account-specific information. Examples of this may be:

If you are communicating with the firm by email, you should avoid including this information in your first message. Instead, you should begin by sending your request to cancel first. Then you should comply with their request for the information.

Then, hop on to the next step.

Step 6: Check the terms and conditions.

They will either recite the terms and conditions linked with the cancellation to you verbally or send them to you in an email.

Last but not least, before you hang up the phone or close the email, make it a point to inquire about the representative’s name, in addition to the date that your cancellation will take effect and a confirmation number.

If Experian decides to charge you again in the next months, providing these particulars throughout the refund procedure would be helpful.

Step 8: Look for charges.

Recommended: Cancel Match.com Subscription and Get a Refund

What should you do if you need to cancel an Experian subscription that was previously held in the name of a loved one who has passed away? If you are in charge of executing executor obligations on behalf of an estate belonging to a loved one, which puts you in charge of canceling financial services like Experian, here is what you need to do.

Step 1: The first thing you should do is switch to a free membership.

You can easily cease the monthly payments on a subscription membership by converting the membership to the free version, as was mentioned above. This can be done fast. You will need the password that the dead person used, which they may have written down or stored in a password manager before they passed away.

If you are getting the person’s mail, you should put away any invoices or paperwork about loans or credit cards, especially if they include account numbers. It is possible that you may need them in order to terminate your membership.

Step 3: Conduct an email search for the term “Experian.”

You are able to search the person’s email archives for the term “Experian” if you have access to their email account. This might result in the discovery of confirmation emails pertaining to their account, including their account number.

Because it is possible that canceling the membership of a dead person may be more difficult than canceling your own membership, it is in your best interest to contact Experian and talk with a customer care representative. They are able to inquire about certain aspects of the account and then advise you on the next steps to take.

This is a reminder that the phone number is 1 (479) 343-6239.

Step 5: The fifth step is to provide personal details.

You will most likely be required to supply the Social Security number of the dead individual, in addition to their complete name and maybe other personal details.

Step 6: Follow through with verification, cancellation, and monitoring in the next step.

You will want to keep a watch on the accounts of your departed loved one, just as you did with steps six through eight which were stated in the preceding section. Additionally, it is as crucial, if not more necessary, to ask for specifics on the cancellation and to continue checking the account of your loved one for any unauthorized expenditures.

Conclusion: When it comes to things like monthly subscriptions, one of the most frequent mistakes that individuals do is forgetting to cancel service after the first free trial period has passed. If you sign up for a free trial with a service such as Experian, it is a good idea to jot a note in your calendar or set a reminder on your phone to remind you to cancel your Experian subscription in two weeks. Alternatively, you might set a reminder on your phone.

This provides you with enough opportunity to postpone for a number of days without incurring any further expenses than are absolutely required. In addition to this, it assists in organizing the digital footprint that is left behind.

Also Read: Cancel eHarmony account

Frequently Asked Questions (FAQs):

Canceling your own Experian membership or the subscription of a loved one might be a complex process. The following are some of the questions that are asked the most often.

Your membership with Experian can be terminated at any moment, that much is true. You may be eligible to request a refund on a prorated basis for some Experian subscriptions.

Regrettably, you cannot cancel your Experian subscription via the website. You will only be able to change your membership to the free version, but doing so will enable you to cease paying payments on a monthly basis. To completely terminate a membership, however, you will need to contact the firm either by phone or email.

Your information will typically be kept by Experian for up to one month. In the event that you change your mind, you will be able to reopen the account and begin your membership again thanks to this feature. If you wish to join up for an Experian membership once again after that amount of time has passed, you will be required to start over and become a brand-new member instead.

Published On : September 27, 2022 by: Anjali Latwal/Category(s) : Trending

Leave a Reply