Purchasing a house may appear hard and even intimidating, but with the correct knowledge and guidance from a professional, it can be a simple process. You don’t need to know everything before you begin; your Caliber Home Loans, Inc. (“Caliber”) Loan Consultant will walk you through the process, explaining your alternatives and making recommendations. This guide will assist you to acknowledge all the crucial steps for the same via Caliber Home Loans.

Finally, purchasing your own house is a fantastic way to begin the next chapter of your life.

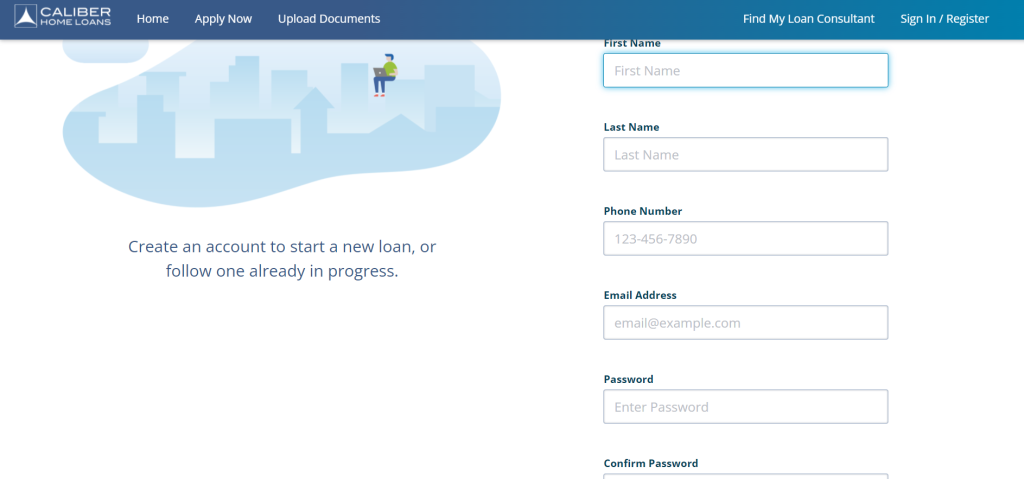

Why should you create an account?

After you’ve finished your My Account registration, you’ll be able to do the following:

What are the options for first-time homebuyers?

Purchasing your first house is a major step. It’s likely the largest single purchase you’ve ever made, and coming up with the necessary finances might be difficult. So, if they are wondering whether there’s anything you can do to make things a bit simpler, the answer is yes.

Caliber Home Loans offers solutions to assist homebuyers who are in less-than-ideal financial situations in realizing their dream of homeownership.

First-time homebuyers may be eligible for the following assistance:

Although not all of these programs are accessible in your region, it is well worth your time to see whether you are eligible for financial aid.

What are the expenses of closing? And who foots the bill?

Closing fees may catch you off guard if you’re a first-time purchaser. These are out-of-pocket costs that encompass a variety of fees associated with the mortgage financing procedure. Closing expenses typically range between 2% and 7% of the purchase price of the house. These costs are in addition to the sale price you agreed to with the seller.

Closing expenses may include the following:

| Fees for lawyers |

| To see if there are any liens on the property, conduct a title search |

| If there are any lien claims, title insurance can protect you and the lender |

| Taxes on transfers |

| Appraisal to ensure that the home’s current market worth and loan amount are compatible |

| As part of the loan approval process, a home inspection is necessary |

| Interest that has been paid in advance |

| In exchange for a lower interest rate, you pay a discount or mortgage points cost |

| For down payments of less than 20%, prepaid private mortgage insurance (PMI) is available |

| The price of underwriting |

| Get a copy of your credit report |

| Fees for the application and origination of the loan to cover the time and paperwork involved in the loan’s processing |

Some of these charges are paid in advance before the property is formally sold, while others are paid when the sale and loan are completed. You’ll almost certainly need to open an escrow account to keep track of your tax and insurance payments. At closing, you will often be required to prepay the first year’s property taxes and home insurance costs.

Some closing fees are also covered by the seller, including:

| Taxes on purchases |

| Fees for transferring title |

| Fees for lawyers |

| There are certain closing costs. |

| Commissions paid to real estate agents |

How to figure out how much your closing fees will be?

When it comes to predicting your closing expenses, there is no one-size-fits-all method. Because the expenses are established by the state, county, and municipal governments, this is the case. These legal criteria might be rather diverse. You can’t assume that closing expenses in one neighborhood will be the same as those in another. Fortunately, by utilizing an online closing cost calculator, you can get a fair sense of what yours will be. Better still, seek the advice of a local real estate agent or lender. Their knowledge of the area might be quite valuable.

How to cut your closing fees in half?

Although the majority of closing expenses are inevitable, there are things you may do to minimize them.

What should I put aside for a down payment?

While the majority of house loans demand a down payment, the amount varies depending on the lender, loan type, and credit score. If you’re a first-time purchaser, a reasonable rule of thumb is to put down at least 6%. Other loan forms, on the other hand, may just demand a 3% down payment. On traditional loans, down payments of less than 20% will necessitate private mortgage insurance (PMI).

Here are some significant factors that will guide you if you are planning to get a service from Caliber Home Loans.

So, how long will this all take?

As per the National Association of Realtors, most purchasers see 10 houses over the course of ten weeks before making an offer on one. And this is only the beginning of the process of purchasing a property. Many lenders require at least 45 days to close, from the moment they submit a loan application to the time they actually close. Caliber Home Loans takes pride in having some of the fastest closing speeds in the business. Caliber has used cutting-edge technologies to make the home loan process go faster and smoother. We’ve moved to qualify borrowers from application to closing in record speed, sometimes as little as 10 business days*, because of this high-tech strategy.

Published On : November 8, 2021 by: Miti Sharma/Category(s) : Banking & Finance

Leave a Reply