One of the responsible credit cards that you can have is American Express Bluebird Card featured with Walmart. The card is a bit different from other regular credit cards. It is based in New York and was established in 1850. American Express Bluebird Card will allow you to only use the money that you already have in your account. What are the things that you can avoid because of this considerable feature? Let me pick for you its, bounced checks, interest payments, or overdraft fees.

In terms of the charges, the company doesn’t charge the monthly service fee. However, here is the list of charges of American Express Bluebird cards-

| ATM balance inquiry | $2.50 |

| Activation fee | $0 |

| Card replacement fee | $0 |

| Close account fee | $0 |

| Free In-Network ATM withdrawal | Yes |

| No PIN purchase transaction fee? | Yes |

| No signature purchase transaction fee? | Yes |

| Card reload fee | $0- $3.95 |

| Signature purchase transaction fee | $0 |

| PIN purchase transaction fee | $0 |

American Express Bluebird allows you the maximum balance of $100,000. In case you are close to the criteria then it’s the time where you need to shift your money to an account where you obtain interest like a savings account, money market account, or a CD.

Who Should Go For The Bluebird Cards?

Want To Know The Benefits Of The Bluebird Card?

Here is the list that is offered by the American Express Bluebird card-

| No activation, Monthly or Annual, Dormancy, Replacement card fee, and Foreign Exchange |

| Early Direct Deposit- receive paycheck 2 days faster before the actual day |

| ATM withdrawals free of charge for 24,000 + MoneyPass ATM |

| Cash reloading at Walmart is without any cost |

| Free bill pay online |

| Mobile application with useful functions |

| Family accounts free of cost |

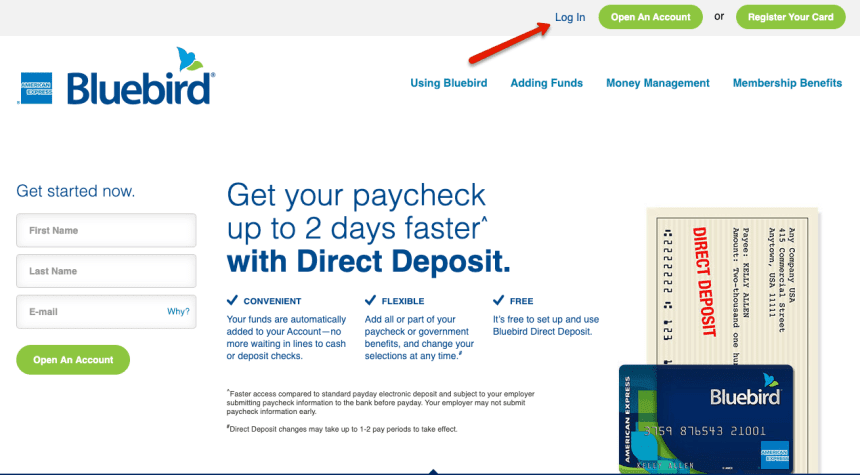

There are instructions given below for you to proceed with the process to register your Bluebird card via Bluebird.com.

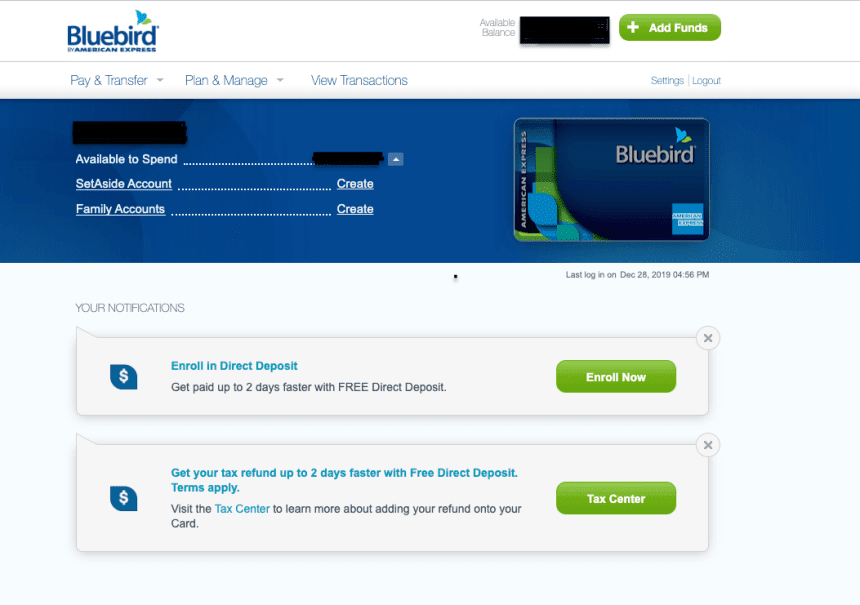

Here Is How You Can Check Bluebird Card Balance-

You are given the method here through which you can check the balance of your Bluebird card.

Temporary balance-

To begin with, you need to check the temporary balance of your Bluebird card. These things are what you need-

Here you go with the link which will direct you to the main page where you would be able to check the balance of the Bluebird Card- Balance page.

Permanent balance-

There are two methods to check the permanent balance of your Bluebird card, either online or via phone. First, tap on this link- login page to log in to your account. Log in by entering the credentials and you would be able to access your card permanent balance and other details.

You Can’t-Miss These Perks Of Bluebird Card!

The American Express Bluebird card arrives with some amazing features that attract the most customers. Here are the top 5 benefits that you are offered with your card-

You can get free access to your cash on your Bluebird account through the ATM for over 30,000 MoneyPass locations of the ATM. Through the feature of Cash Pickup, you can obtain cash at 4000 + Walmart stores.

You can send money to anyone via Bluebird2Walmart Money transfer. The money can also be transferred between the accounts of Bluebird without any cost.

The checks can be turned into cash in your Bluebird account through the application of Bluebird easily, by Check Capture by Ingo Money App. In the case of you depositing the check using this feature. You would be able to access your money in 10 days, however, the check should not return unpaid. Your money can be accessed anytime without charging anything from you.

The point of Direct deposit is quite significant as you get to enroll in Direct Deposit and experience the feature of obtaining money 2 days faster.

Here you get this advantageous specialty where up to 4 cards can be given to anyone based on your preference. You also get to set the limitation according to you only, ATM access, and other related functions which will assist you with planning your money.

Published On : October 16, 2021 by: Miti Sharma/Category(s) : Banking & Finance

Leave a Reply