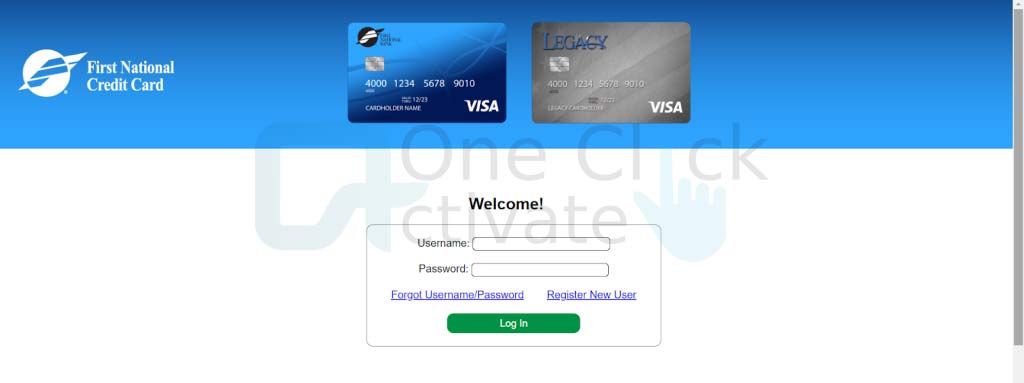

If you don’t register right away, Blaze will remind you to do so before you can make an online purchase from a participating retailer. The essential details you require as a Blaze credit card holder to access your account online, make payments, and get in touch with customer service for more help are provided here. Be aware that there are two distinct Blaze cards: a Mastercard and a Visa Card. Each has a unique login, payment, and customer service information.

Table of Contents

Mastercard SecureCode, a free solution offered by Blaze to improve your current Blaze Mastercard account, is now available. When you shop online at participating merchants, you are protected against unauthorized use of your card with a personal security code.

You simply enter your private SecureCode at participating online retailers’ checkout when prompted by Blaze. The SecureCode functions exactly like a Personal Identification Number (PIN) at the ATM. Your purchase is finalized once your identity has been verified.

You have the option of signing up right away for this extra security or later on when you shop at partner online retailers. It is quick, simple, and free to enroll in. Once you’ve created your SecureCode, you can use it to make purchases in the future.

Using your mobile iPhone®, iPad®, or AndroidTM smartphone and the Blaze Mobile App, you can:

Recommended: Activate Belk Credit Card

As of August 2021, the Federal Reserve reported that the average annual percentage rate (APR) for all credit cards was slightly over 17.13 percent. The Blaze Mastercard’s purchase APR is 29.9%, which is significantly higher than the country as a whole. A higher APR will result in you paying significantly more interest fees if you use your card to carry debt from month to month.

Consider a credit card with a $1,000 balance, an APR of 17.13 percent, and a $35 minimum payment per month to put those figures into context. You would pay $294 in interest over the course of 37 months to pay off your debt. It would take 51 months to pay off a $1,000 credit card amount with a 29.9 percent APR and a $35 minimum payment per month, costing you $770 in interest fees. You would pay an additional $476 in interest due to the higher APR. Check for a card with a reduced APR if you frequently carry a balance, such as the Credit One Bank Platinum Visa card.

But while the Blaze Mastercard has few advantages, it does have:

Standard security features offered by this card include 24-hour account alerts. Additionally, as long as First Savings Bank is notified immediately once your card is lost or stolen, you will never be held liable for any unauthorized transactions.

Pros Explained-

Unsecured Credit Line Access: If you have bad credit or no credit at all, you may only be eligible for secured credit cards, which could include paying a large security deposit. The Blaze Mastercard can be a good substitute if parting with your hard-earned money doesn’t appeal to you. Although if your credit is less than ideal, you can be eligible for this card and have access to an unsecured line of credit.

Obtain a Credit Line Increase: Cardholders who maintain a solid payment history and account status may be eligible for a credit line increase in as little as six months. There is frequently no defined timeframe for becoming eligible for a credit line increase on cards for persons with bad credit. A good perk is gaining more purchasing power in less time.

Cons Explanation-

Costly Costs: You should be aware of two significant fees before applying for the Blaze Mastercard:

Before using this card, you must pay a $75 annual fee. This cost lowers the amount of credit you have accessible. If you are granted a $350 credit line, for instance, the fee would reduce your available credit to $275.

Authorized user fee: $20 will be charged each year to add an authorized user, such as a spouse or partner, to the account.

Other credit cards don’t charge them, despite the fact that cards for those with bad credit typically have hefty fees.

Another choice for someone establishing credit is the Petal card. It is also an unsecured card that does not charge the annual, foreign, authorized user, or late payment fees.

Sadly, there is no rewards program with the Blaze Mastercard. When you use your card, you won’t accrue any points, miles, or cash rewards. Even though that is typical of cards created for those with poor credit, it is nonetheless upsetting. There are options that give incentives if you’re willing to apply for a secured credit card rather than an unsecured credit card and pay a refundable deposit.

Payment options-

Using their automated phone system or their website, you can pay your bill without incurring any fees. Additionally, you can send money using MoneyGram’s code 5879 or Western Union’s City/State: Blaze/SD codes.

Customer service representatives accept debit card payments for a $3.95 processing fee. Click here to locate locations where you can pay with cash.

Payments for Blaze Mastercard should be mailed to the following address:

Blaze Mastercard

PO Box 2534

Omaha, NE 68103-2534

There are three other methods to pay with your Blaze Credit Card. The procedures are detailed below.

The steps below should be followed to make an online Blaze Credit Card payment:

Your phone can be used to make Blaze credit card payments.

To make a payment, you can also call the Blaze Credit Card Customer Service Number. Call the Blaze Credit Card customer service line at 1-605-782-3472, and then adhere to the on-screen instructions to make your credit card payments.

Trending: Activate First Phase Card

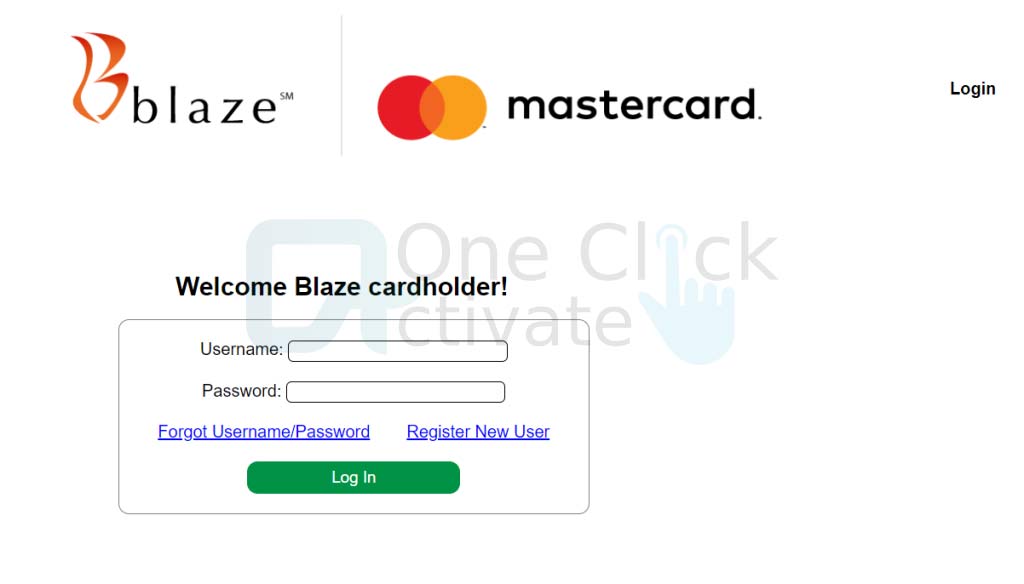

Now, just follow the instructions below and you are one step behind accessing your Blaze account online.

The Blaze Unsecured Credit Card is the go-to card for consumers to start repairing their credit because applying online is quick and safe.

You can be eligible for an increase in your credit line in as little as six months if you maintain good credit on your card account.

Blaze is reliable and sincere.

Here are the steps you need to follow:

First step-

Your first step is to provide your personal information including the following in the prompted fields:

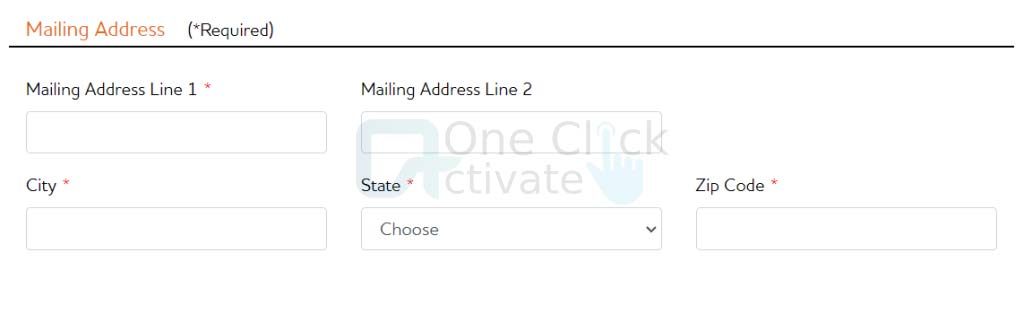

Second step-

Your second step is to provide your detailed mailing address including the following in the prompted fields:

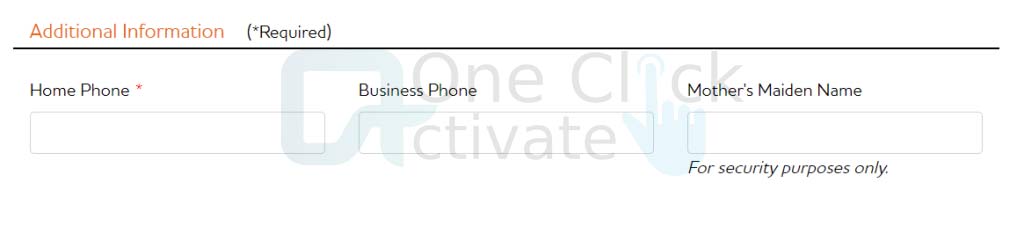

Third step-

Your third step is to provide your additional information including the following in the prompted fields:

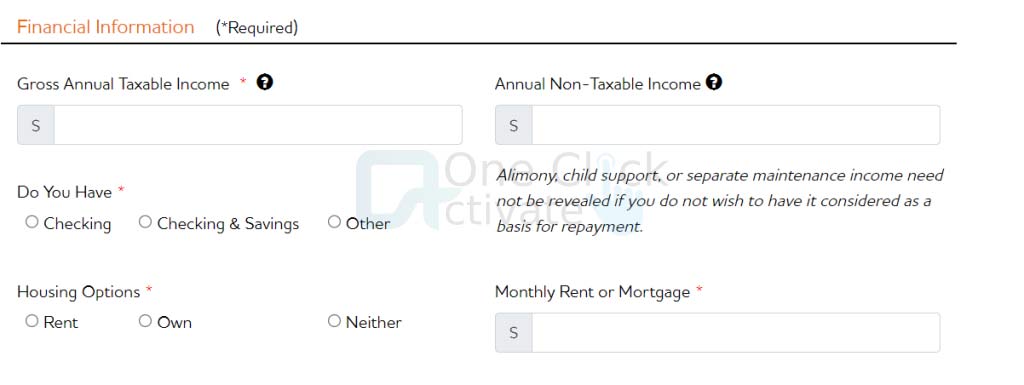

Fourth step-

Your fourth step is to provide your financial information including the following in the prompted fields:

Fifth step-

In the last step, you just need to click the orange button prompting “Preview Application” to re-check the details you have entered in your application. Once, you are satisfied with your details, keep following the on-screen directions and you will be done in no time!

Also, check out our guide on how to Activate TD Bank Gift Card

Payment Address:

Blaze Mastercard

PO Box 2534

Omaha, NE 68103-2534

Correspondence Address:

Blaze Mastercard

PO Box 5096

Sioux Falls, SD 57117-5096

Customer Service:

866-205-8311

So, that was all in the guide for Blaze credit card and we hope you liked it!

Published On : July 17, 2022 by: Sakshi/Category(s) : Banking & Finance

Leave a Reply