Want to learn about how to activate Big Lots Credit Card? We’ve explained it thoroughly to you. Learn everything about Big Lots, its pros and cons, including the Big Lots credit card activation and login process in this article. Let’s start.

About Big Lots:

Big Lots is a Fortune 500-listed national retail giant that carries the most well-known name brands that Americans like. Since the company’s doors were opened in 1967, 1,445 locations have been built in 47 different states. This company, known for selling living room sets and other common household items, provides everything needed for someone moving out of their home or just want to renovate it.

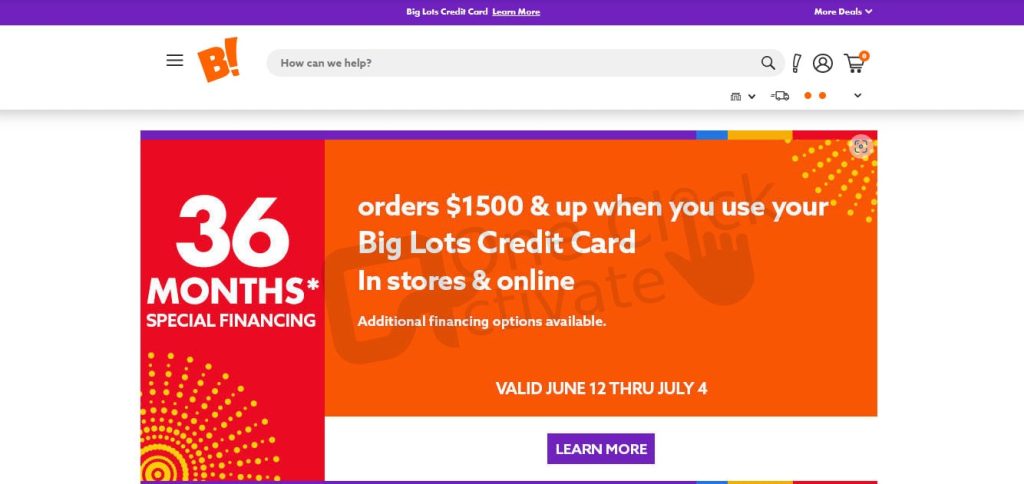

There is now a Big Lots credit card accessible for devoted consumers to use in order to make purchases without paying in full. This is due to Big Lots’ enormous success and lengthy history as well as the fact that this shop sells everything a person needs. Please continue reading so that we can demonstrate to you all aspects of the highly fascinating Big Lots credit card.

Are you searching for a new credit card? Maybe you want a credit card from a retailer you frequent or maybe you simply need a boost when situations arise. You can learn everything there is to know about the Big Lots credit card here in this article. You will know after reading this whether to purchase this card or maybe another card with more flexible perks.

When money is tight, this card is the ideal ally. As there are no yearly fees, it springs into action and rescues the day. For those like us, who actually detest such additional costs, the perk stands alone as a significant advantage. Let’s examine some of the fantastic benefits that this card provides.

How does the Big Lots Credit Card look physically?

To examine the unique physical characteristics of the Big Lots credit card, let’s turn it around as if it were an exhibit at a museum. The words “Big Lots!” are present in bold white type on the upper half of the front of the card, nearly leaping out at the reader.

The whole bottom half is orange, and a straight line divides it from the upper half. The front of the bottom half has your first and last name and a unique credit card number. The card also includes the CCV numbers and the usual credit card marks, such as the black magnetic strip that handles payments, if you flip it over to the back. Nothing noteworthy occurs there. It slides into your pockets or wallet just as any other credit card does.

Close alternatives to Big Lots Credit Card:

Benefits of the Big Lots Credit Card:

The Big Lots credit card is a reliable and secure method to pay for daily expenses, including food, toiletries, outdoor gear, electronics, and anything else you may think of that will make your vacation easier. This implies that when traveling, you shouldn’t be without any necessities. Fortunately, there are several Big Lots stores around the nation, usually in or near the big cities, and they provide a variety of necessities. By making the right or left turn on the exit ramp as you approach certain urban neighborhoods on the highway, you can ask OnStar, Siri, Alexa, the magic 8-ball, or even a genie in a bottle for instructions.

In this shop, you can find just about everything you can imagine on the shelves. You won’t feel alone in receiving a discount with your credit card since many Big Lots consumers visit this shop solely for daily specials. Because there is no need to pay a high-interest rate, using a Big Lots credit card is the best option for making very costly, large purchases.

Big Lots Credit Card: Pros and Cons:

Some of its major advantages are:

Some of its major disadvantages are:

You must first have a credit score between 650 and 840. If you do, the game is now yours.

After applying for the card, you will have to provide the following information:

After the approval procedure is complete, the card will be issued and take 7 to 10 business days to arrive in the mail. If you want to conserve the environment, you can manage your accounts online at any time of the day or night and request a paperless bill.

The bank that offers the card, Comenity Capital Bank, also issues a lot of major retailer credit cards. This banking organization will make the decision about your eligibility for the card. You’ll have to make sure they’re happy, sire.

You must make the minimum monthly payments, just as with any credit card. This card has the unusual feature that you won’t have to worry about if you leave it behind at home. You don’t have to go back and travel a long way to acquire your credit card. Your account information can be found on the shop clerk’s computers, and the purchase can be applied. Hello, cashless and plastic-free transactions. For everyone who wants common items when traveling, this credit card is perfect.

Big Lots Credit Card Login Process:

The Big Lots Credit Card Purchase and Maintenance Fees:

The purchase APR, which is rather high for a credit card, is 29.99 percent. You can now purchase furniture with the Big Lots credit card thanks to a partnership with Progressive Financing. That is a big advantage for individuals moving to new locations and establishing new lives. Therefore, in a situation like this, you wouldn’t have to pay a hefty interest rate.

Consider the possibility that you may soon completely decorate your new residence without spending a dime. Always for spiritual reasons, I travel. I act on what my intuition tells me to do. But if I don’t have the money to leave my present circumstance, my destiny is already decided. That is how I see the situation.

Without levying these fees, how else might credit cards generate revenue? They are essential. The minimum interest rate is 2 percent, but if you pay off the debt within 6 months, you won’t have to pay interest on purchases of $250 or more. Additionally, interest is waived if you pay off your major purchase of $750 or more within 12 months.

The Big Lots Rewards Programs:

The concept of receiving incentives for purchases appeals to people greatly. But until you apply, Big Lots won’t enroll you in the rewards program. You can use the Big Lots BIG Rewards in conjunction with your Big Lots credit card.

The rewards program is open to everyone who wants to participate. Just remember to keep an eye out for the sporadic special offers that are often provided without notice. Make careful to open the links and take advantage when those offers start to appear in the email since they aren’t common. You can always seek an increase in your credit limit, which would be a reward for you.

Conclusion:

Big Lots Credit Card can be a wonderful option for your pocketbook if you exclusively buy from Big Lots. However, if you spend money in a variety of locations as most people do, another card could be a better match for your way of life. So, that was all about the Credit Card from Big Lots, its activation and login process, and its major advantages and disadvantages. We hope that you will find the content of our article on Big Lots beneficial. Also, please do not forget to leave your insightful remarks in the empty section below if you do so.

Frequently Asked Questions (FAQs):

This card can only be used at Big Lots retail locations. It cannot be applied to different brands. However, Big Lot shops often provide everything you need, eliminating the need to shop elsewhere. Well, there could be better credit card possibilities for you if you don’t only buy at Big Lots.

Well, let’s be honest, we are all aware of how difficult paying a bill can be. With the Big Lots credit card, it no longer needs to be a taxing job. You can phone the business to pay your debt. Simply establish the inquiry by calling 888-566-4353 on the customer support line, and presto—your account is paid. A money order from the post office or currency exchange might also be sent. You can also pay using cashier’s checks or personal checks.

The Big Lots credit card’s late payment penalties sometimes, even for returned payments, can be as high as $38, which is a lot. But if you’re a good person, you can escape this punishment. Simply be mindful of your spending and monitor when you pay your bills.

The following credit reporting agencies are informed about your account activity by Big Lots Credit Card:

1. Equifax

2. Experian

3. Transunion

Regularly paying creditors who report to one or more credit agencies on schedule would show that you are responsible with money and might help you build better credit.

Description of the Big Lots Credit Card Purchase Intro Offer.

1. 0% is the introductory rate.

2. 24 months purchase introductory APR period

This card does provide an introductory APR rate of 0% on eligible purchases for a maximum of 24 months.

The average normal APR is 15 percent for all credit cards and 17 percent for accounts that have a balance, according to the Federal Reserve Board. Regular APRs on this card is higher than typical. The variable purchase APR for the Big Lots Credit Card is 29.99 percent.

Published On : July 5, 2022 by: Anjali Latwal/Category(s) : Banking & Finance

Leave a Reply