If you are seeking the fastest-growing mortgage bankers then here it is, American Financial Network Inc. It is one of the nation’s fastest-growing mortgage bankers, and it is among the top 50 nationwide. But they’re not content with that, and they feel they have what it takes to crack the top ten at some point. Of course, at the very top of the heap, the rivalry is severe. They are not just a fast-growing firm, but also a highly regarded one, ranking among the top three lenders on LendingTree based on client feedback. Given the fact that there are over 800 mortgage lenders listed, this is rather outstanding.

Table of Contents

Since 2001, American Financial Network, Inc. It has lent money to real estate agents, builders, and individual customers all around the United States. Their mission is to be the greatest, most trusted, and admired mortgage lender in the industry by providing creative, inexpensive, and easy products while keeping a tight, family-oriented culture.

Checklist Of American Financial Network

During the loan application process, the following information is usually required-

If You Already Have Real Estate-

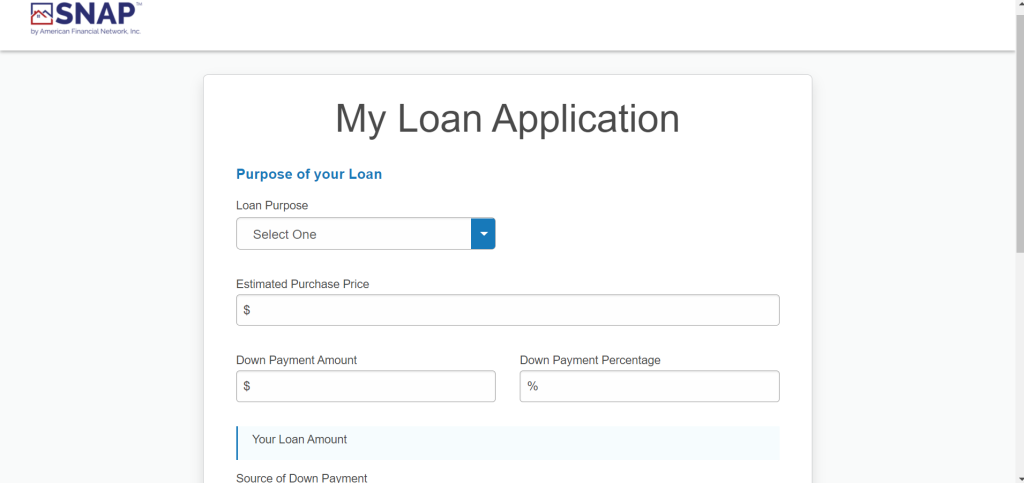

They also provide completely underwritten mortgage pre-approval, so you may feel confident about moving forward as a house buyer. If you’d want to apply for a house loan, you may do so online or using their free smartphone app. Apparently believe they have an Ellie Mae-powered digital mortgage application that allows you to do most chores electronically and It is called SNAP.

You’ll get a to-do list with the option to scan and submit conditions, eSign papers, and follow loan progress 24/7 after your loan is accepted.

American Financial Network Offers A Variety Of Loans

American Financial Network is a mortgage banker, which means they have correspondent agreements with a variety of investors to guarantee they have access to any loan product a borrower would require. This enables them to market credit products from other firms, giving them a greater range of options than other lenders.

Additionally, if you have a unique lending circumstance that cannot be put in-house, their loan professionals may be able to broker out loans. They provide a wide range of financing alternatives, including property purchase, refinance, and remodeling loans. It’s unclear whether they’ve taken out any building loans. Condos and townhouses are eligible for financing as a primary dwelling, second home, or investment property. A conventional house loan backed by Fannie Mae or Freddie Mac, a government loan backed by the FHA/USDA/VA, or a jumbo home loan that exceeds the conforming loan limit is all options.

Pros and Cons of the American Financial Network

The Positive

The Possibly Not Good

Mortgage Rates On The American Financial Network

American Financial Network, like many others, does not publish its mortgage rates on its website. This occurrence leads its potential customers out of the sight wherein they could not possibly acknowledge the mortgage rates. Although credit lenders credit for being transparent by displaying their rates on a daily basis, customers also recognize the limitations in advertising rates, which frequently only match one perfect loan situation.

You may acquire a quick, free mortgage rate quotation by filling out a brief form on their website or phoning them individually. Although you will need to give contact information, the form is relatively brief. AFN might charge a loan origination fee or other usual expenses like underwriting, processing, or application fees because they don’t publish them anywhere.

Make sure to speak with a loan officer to obtain a mortgage rate quotation, as well as the relevant lender fees and mortgage APR, so you can compare your rate to those offered by other lenders.

Here are the loans programs mentioned which are offered by the AFN- American Financial Network.

For most applicants, industry-standard lending programs with buy and refinancing choices are available. These programs adhere to Fannie Mae and Freddie Mac lending guidelines and have a reputation for being the most cost-effective and time-efficient in the mortgage market.

These loans, which are regulated by the Federal Housing Administration, are an excellent alternative for first-time homebuyers, homeowners searching for straightforward refinancing options, and borrowers with less-than-perfect credit.

This event is just for soldiers and their surviving spouses! You may finance up to 100% of the value of your new house with no money down and no private mortgage insurance, or you can refinance your existing home fast and conveniently with minimum paperwork.

Acquire or refinance property located in a remote region (as recognized by the U.S. Department of Agriculture) (as designated by the U.S. Department of Agriculture). Most borrowers are eligible for these loans, which provide up to 100% of a property’s worth.

Programs that cover not just the value of the house as well as the price of any changes you would like to undertake. Renovation loans help in gaining value in the house while completing the project!

They can handle a large loan amount if that’s what you’re searching for. Jumbo loans are offered for sums ranging from $500,000 to $2,000,000, and occasionally much more.

Do you work for yourself and need to certify using your bank statements rather than your tax returns? Do you require a loan for an investment property but do not wish to submit proof of income? Do you have a unique situation that other lenders won’t consider? Most likely, they have a specialized product that can assist you.

Do you have enough money to make monthly mortgage payments but are having trouble saving for a down payment and closing costs? You might be able to take advantage of low-interest rates to be a homeowner and lock in your monthly housing payment for the next 30 years. AFN provides a variety of Down Payment Assistance Programs to assist first-time homebuyers with the initial costs of purchasing a house.

The information is enough about AFN- American Financial Network if you are planning to apply for it. It’s just a matter of some factors that really make a difference which you need to give a good look. Everything is mentioned in the article above which is necessary for you to know.

Also Read: Apply For Freedom Mortgage

Published On : November 28, 2021 by: Miti Sharma/Category(s) : Banking & Finance

Leave a Reply