ReleasePay.com Activate Card: Looking for an easy solution to activate ReleasePay card online at www ReleasePay Com Activate Card, without much hustle and bustle? Worry not, we’ve got you. In today’s guide, we will tell you all about this multi-purpose card, its features, benefits, and how to activate your ReleasePay card online in the easiest way possible. So, what are you waiting for? Hop on for the ride to know the activation procedure via www.releasepay.com activate card.

Table of Contents

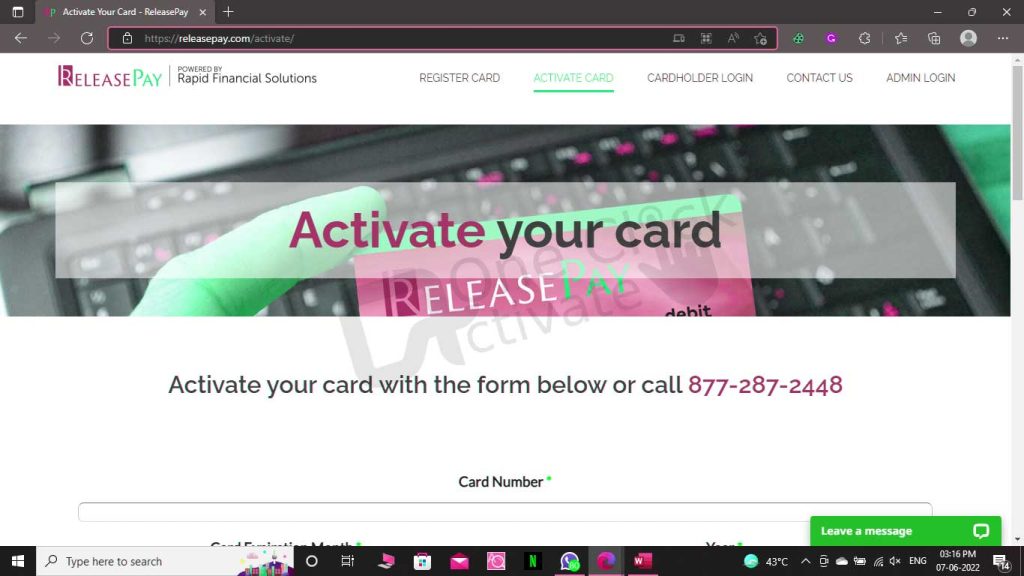

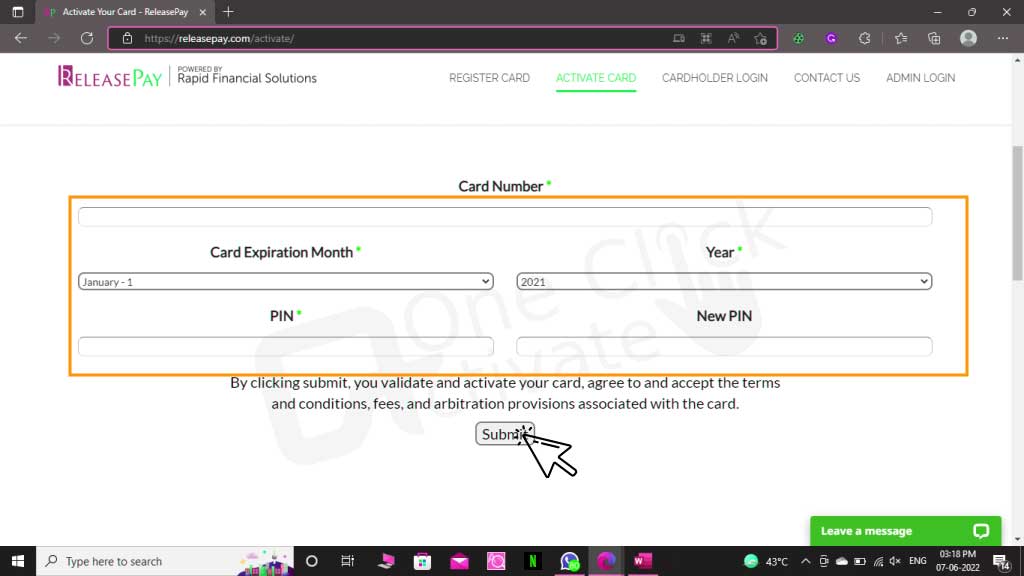

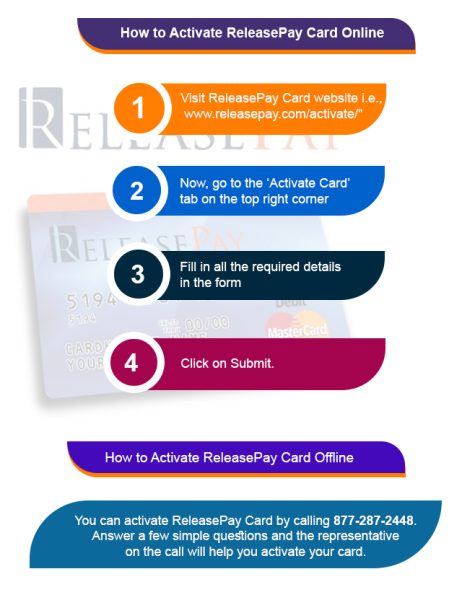

In order to activate your ReleasePay Card online via releasepay.com Activate Card, just follow the simple steps below:

Alternatively, you can activate ReleasePay Card by calling 877-287-2448. All you have to do is answer a few simple questions and the representative on the call will help you activate your card.

Author’s Chioce: Activate SecureSpend Visa Debit Card for Purchases and Check Balance (Updated Guide)

Before activating the account via releasepay.com activate card you need to login to your ReleasePay Account. How to log in to my ReleasePay account?

Note: If you are a new user, you can click on Register to first create an account before you follow the activation procedure at WWW Releasepay Com Activate Card.

‘Release Pay Debit Cards – Pre-Loaded Debit Cards Provided Upon Release to the Jail Inmate’

The IDOC introduced a new initiative that will help those who are being released from detention as part of an overall approach to making life simpler for prisoners and their friends and family who support them. These release debit cards are provided and supported by Access Corrections via its subcontractor Rapid Financial Services. Instead of checks, these pre-loaded debit cards, dubbed Release Pay Cards, are distributed upon release from detention.

If the check holder does not have a bank account, most banks will impose a check-cashing fee. This potential expense is removed with their new solution. The leftover cash from residents’ jail accounts is pre-loaded on the Release Pay Cards, which are activated completely for free. You can activate the card at WWW ReleasePay com Activate Card (Releasepay.com Activate Card). The Release Pay Cards are valid for five years. If a card expires, customers can contact customer care for a free replacement. Your money will not be charged any maintenance or inactivity fees after it is loaded into the debit card.

Recommended: Activate TBN Network at watch.tbn.tv/activate: The Complete Guide

Every cardholder is entitled to the following sorts of transactions or services at no cost:

The costs listed below are related to the debit release cards being issued herein, and they are the sole fees that may be imposed on any cardholder or against any available balance on the card. Once you activated your card at Releasepay.com Activate Card you must be aware of the charges for different transactions

CHARGE** FOR TRANSACTION / USAGE TYPE:

| Fee for Account Inquiry | $1.50 |

| ATMs in the Domestic Area | $2.75 |

| ATMs in the Domestic Area Decline Fee (NSF) | $2.75 |

| ATMs from across the world Fees | $3.75 |

| ATMs from across the world NSF (Decline Fee) | $3.75 |

| In the event that your item is misplaced or stolen, for a replacement Card | $0.00 |

| Account Termination Fee for cashing out a card’s balance and receiving a check | $0.00 |

Trending: Activate Today Mastercard and get your customized controls

So, this is how you can activate your ReleasePay card online via www ReleasePay com Activate Card in just a few simple steps. We hope you find the content of our article useful. Do leave your valuable comments in the section below if you have any doubt.

No. Debit release cards are completely free to load and activate. When loading release money onto a debit release card for a person who is being released, no charge is applied to or deducted from the available sum. You can Activate ReleasePay card via Releasepay.com Activate Card without paying money.

Yes. The Release Pay card is valid for five years. If your card expires, contact customer support to get a replacement. There is no charge.

No. No monthly service charges or inactivity fees are applied to the cardholder or deducted from the card’s balance at any time.

By visiting any MasterCard-affiliated financial institution, you may get a cash advance to pay off your full card amount for free. When making a purchase, you may also use your card as a debit and request cash back.

No, you won’t be able to reload your new card. If you’d like to get a general-purpose reloadable card, go to the website listed on the back of your card and follow the steps.

Your card may be used everywhere MasterCard Debit is accepted. To make transactions online, over the phone, or by mail, you must first register your card online. The security of your cash will be ensured by registering online. For extra protection and advantages, such as Mobile Alerts, 24/7 Transaction Monitoring, and Fraud Protection, please visit the URL on the back of your card.

You may reset your PIN at any time by calling the number on the back of your card. At the time of issue, you will be given a temporary PIN. Your PIN is the code that gives you access to all of your pinned point-of-sale purchases.

You may use your new card to make purchases with either credit or debit. To validate the transaction, credit utilizes your signature on the receipt, while debit uses your Personal Identification Number (PIN). If you use your card as credit, you’ll be covered by MasterCard’s zero-liability guarantee.

Before making a purchase, double-check your balance. The transaction will be denied if the purchase amount exceeds your balance. You may tell the merchant that you’d want to pay using several methods, indicate how much you’d like to put on your card, and then pay the difference with a different card, cash, or check.

Rapid Financial Services may be reached by calling 1-877-287-2448 or visiting www.releasepay.com.

Published On : December 21, 2022 by: Anjali Latwal/Category(s) : Banking & Finance

Leave a Reply