Your new Huntington debit card just arrived at your doorstep, but you must first activate it before you can use it. You can do this in a number of different ways, including online, over the phone, or in person at any Huntington branch. Once your debit card has been activated, you can use it to make purchases, pay bills, and use ATMs to withdraw cash or make deposits. So, what are you waiting for? Read this article to find out how to activate your Huntington Bank Debit Card in a few easy steps.

Table of Contents

Typically, when you create a new checking account, your bank will offer you a debit card. You may be able to get a personalized debit card with a look that fits your style. The bank may provide a temporary card when you create a new account in a branch and subsequently send you a debit card if you choose. You will get the card and PIN separately with it.

You must activate your debit card when you get it before you can start using it. Set up online banking and transfer any monies from other accounts to your checking account before using your new debit card. This will assist you in understanding the amount of your checking account and provide you access to useful tools for creating a budget, keeping tabs on your spending, and achieving savings targets.

Also Read: Fix Huntington bank app not working

Debit cards often come with extras and advantages. While they will differ from bank to bank, if you bank with Huntington, you can take advantage of advantages like:

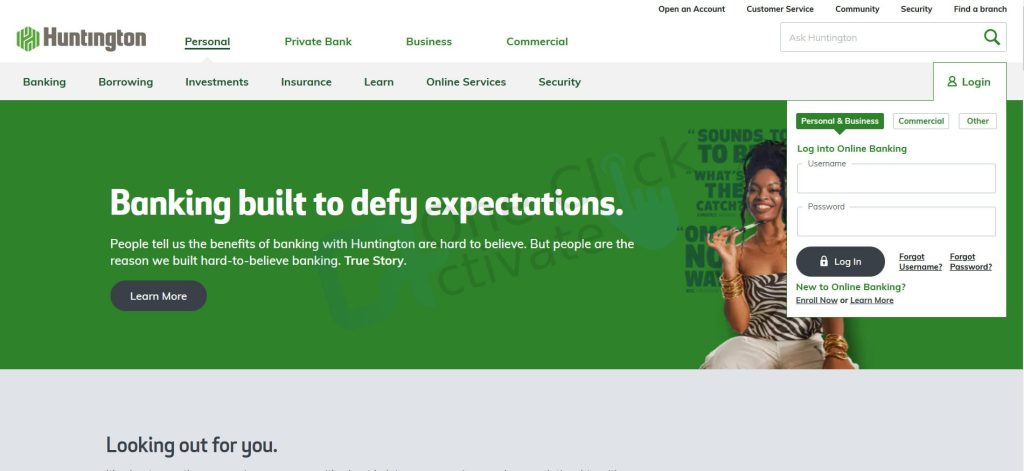

Your debit card can be activated in a few simple steps. Follow these instructions to activate your Huntington Bank Debit Card:

Trending: Fix Huntington Bank Debit Card Errors

Your phone can be used to activate your debit card as well.

If you’d like, you can also activate your debit card by going to any Huntington ATM, going to a branch, or making a transaction using your card and PIN.

Now that you know how to activate your Huntington Debit Card, let’s learn about some other important things about this debit card.

Where Can I Find My Debit Card Number?

You may not notice the meaning of the numbers on your debit card when you swipe it. For online transactions and using your debit card over the phone, you must immediately locate your debit card number, Card Verification Value (CVV) code, and expiry date.

How to Find Your Debit Card Number Online?

You may be able to obtain your debit card number online depending on your bank, but if not, you might want to get in touch with them for further assistance. Here is how Huntington Bank account customers can locate their debit card number on their electronic statements.

Your whole debit card number won’t be visible if you’ve stored your account information with online retailers. Regulations related to PCI DSS (Payment Card Industry Data Security Standards) have made this information anonymous.

Know why is your Debit Card Being Declined when you have Sufficient Funds

Using a debit card makes it simple to make online purchases.

You can use your debit card at an ATM to quickly take money from or deposit money into your checking account.

Check out our guide to Activate SecureSpend Visa card

Conclusion: The Huntington debit card makes it simple to access any available funds in your Huntington Bank account. If you already use Huntington for banking and financial services, getting a card is free, and it allows you the potential to earn interest on your unspent funds. That’s all there is to it when it comes to the process of how to activate your Huntington Bank Debit Card. We hope that you will find the content of our article beneficial. Also, please feel free to add your thoughtful comments in the space provided below if you found the information in this post to be helpful.

Open the Huntington Mobile app on your phone and log in to activate your new card there. Select your card by clicking More, followed by Manage Cards. Click Activate after entering the three-digit security code located on the back of your card.

Call toll-free at 1-800-992-3808 to activate and set a PIN for your Visa debit card or ATM card. If you have forgotten your current PIN, you can call this number to request a new one or to alter an existing PIN. Call 304-528-6209 if you have any inquiries.

Yes, your phone can be used to activate your debit card as well. Use the Huntington Mobile app on your smartphone or dial (800) 480-2265, available every day from 6:00 a.m. to midnight ET.

You can activate your ATM card by Cracking open the bank’s envelope.

– Your debit card and four-digit PIN are stored there.

– In the ATM, insert the debit card.

– Enter the ATM pin issued by the bank together with the debit card number.

– Make a fresh ATM pin.

– To input, your new ATM pin, follow the machine’s instructions.

Some banks may provide a mechanism for you to get your debit card PIN back through their website or app if you’ve forgotten it. For assistance, you can also contact customer service or look for a nearby office. The PIN may need to be reset for security purposes, and you may still be asked to confirm your account ownership.

I forgot my PIN, so, how you can modify the PINs on your personal debit and ATM cards using our app, Huntington.com, or a branch? Huntington offers personal, small company, and commercial financial services, as well as online banking solutions, mortgages, investing, loans, and credit cards.

If you don’t have enough money in your account, transactions can be rejected. Huntington may charge a return fee for this, and the store might charge additional expenses. Applying 24-Hour Grace® If we approve a transaction even though you don’t have enough funds in your account, there will be a fee. Program Administrators and/or cardholders can get help whenever they need it by calling (866) 643-4203, option 2 at that number.

Published On : October 11, 2022 by: Sakshi Sharma/Category(s) : Master Card

Leave a Reply