Learn how to activate the First Phase Card to get equipped with the skills you need to successfully traverse the next stage of your credit journey with First Phase’s moderate credit limits, user-friendly online account, and innovative credit card protection capabilities. So, what are you waiting for? Let’s begin.

About First Phase Card:

The First Phase credit card is a multi-functional credit card that is open to all applicants, although it is created especially for people who have trouble getting credit. The card’s objective is to provide opportunities to individuals who have little access to credit choices. The First Phase card is an excellent alternative if you’ve had trouble securing credit or are seeking more possibilities. Its objective is to provide credit choices that let you establish credit while still reporting to credit agencies. You can map out a fresh course of action with the First Phase credit card. User can achieve their personal green lights with First Phase. You can also shape your future. The First Phase card:

In other terms, it helps you overcome hardship and emerge stronger. It encourages you to take the next action and accomplish the next objective.

Do not miss: Avail of 2% cashback on purchase with Cabela’s Club visa card

What advantages does the First Phase card offer?

VISA provides First Phase Cardholders with the following 3 card benefits:

How can I apply for a First Phase card?

Start here if you want to improve your credit using First Phase. To apply, you will require:

Your application will typically be examined right away. In order to comply with the USA Patriot Act, the companies must confirm each applicant’s identification. That might sometimes take a little longer. They’ll let you know within 30 days. Your new credit card should arrive 10 to 14 business days after its official approval by the authorities.

How do I create my First Phase online account?

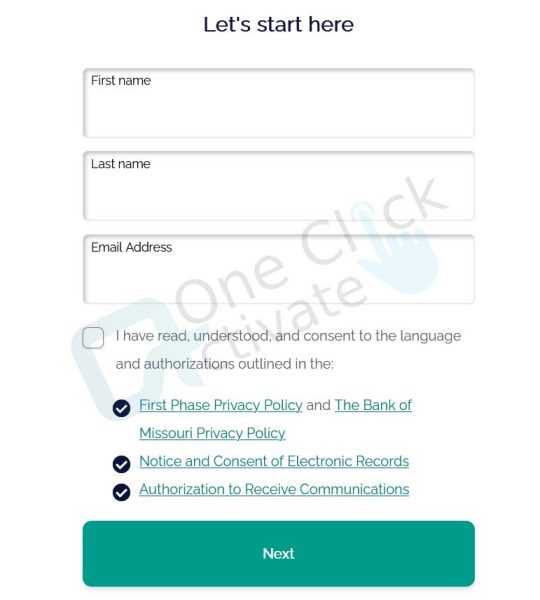

Simply follow the steps below to create your First Phase online account:

After getting the acceptance, you must pay the $89 Program Fee before using your account.

You can undertake the following approaches to activate the First Phase Card:

For online activation of your First Phase Card, you must first have a First Phase account on their website. The steps to create your online First Phase account are underlined above. You can follow them to easily create your account and then activate your brand-new card with its help. You also get additional features by creating your account at First Phase’s official website, such as balance check, customer care help, etc.

Also Read: Guide to activate Priceline Rewards Visa Card

Conclusion: So, that was all about this multi-purpose card, its various benefits, and how to activate the First Phase card. If you follow all the above steps carefully, you will be able to create your account and activate your card in no time. With this, we hope that you will find the information in our article useful and beneficial. Furthermore, please remember to leave your valuable insights in the empty section below.

Frequently Asked Questions (FAQs):

First Phase’s goal is to provide credit opportunities. The approval is not guaranteed; however, they carefully examine your application to ascertain your eligibility.

That’s OK! Everyone experiences roadblocks. If your application is accepted, they would be delighted to evaluate it and help you begin building credit.

Building your credit score involves more than just using the First Phase credit card. An essential initial step is timely payment of the First Phase card debt. Maintaining a low balance, maintaining your credit line. And paying your payments on time are ongoing activities that can help you develop your credit. The three main credit bureaus get activity data from First Phase.

Balance transfers are not something First Phase presently provides.

Yes. Through the company’s collaboration with Visa, First Phase Cardholders have access to identity theft protection.

Live support is available at 855-747-4273, Monday through Friday from 8 a.m. to 9 p.m. CT, and on Saturday from 9 a.m. to 4 p.m. CT. You can contact First Phase at www.customerservice@firstphasecard.com to get in touch with them. You can contact US Postal Service with letter inquiries at First Phase Visa, PO Box 85130, Sioux Falls, SD 57118-5130.

Published On : July 4, 2022 by: Anjali Latwal/Category(s) : Banking & Finance

Leave a Reply